Unit Trust Funds are flexible and more suitable for dynamic, smart investors than traditional deposits.

So opt for a CAL Unit Trust today to design a customized investment portfolio you believe in together with our Unit Trust specialists, while enjoying flexibility and above average returns.

What is a CAL Unit Trust and is it right for you? Call us

CAL Unit Trust Funds has over 130Bn LKR invested and is regulated by the SEC

Dream Big.

Invest in Unit Trusts.

Grow Personal Wealth.

Chart Your Own Future.

Unit Trusts are dynamic and contemporary, just like your lifestyle and goals. Enjoy an equally attractive return to traditional deposits and savings

Enjoy added benefits of being able to pull out your money as you like and the flexibility to invest additional sums whenever you want.

Start with an investment as low as Rs 100

CAL’s Unit Trust Funds are ideally suited for your many savings and investment goals.

- Take a trip abroad

- Build a home

- Save for your kid’s higher education fund

- Redeem funds instantly for emergencies or daily expenses

- You can withdraw without penalties anytime, and interest Is paid daily to your Unit Trust Account.

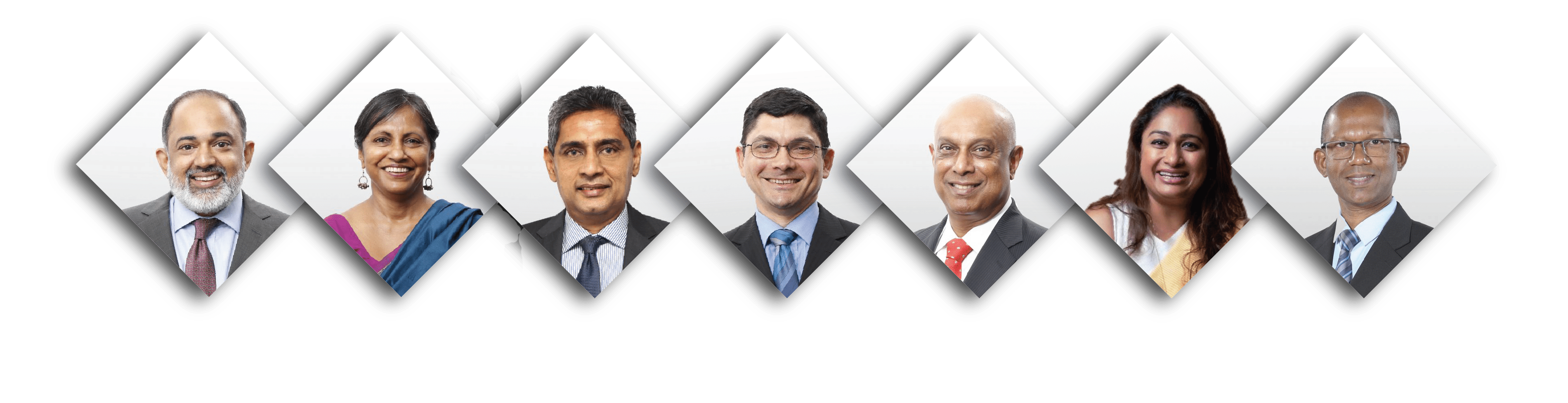

Professionally managed by the island’s top investment experts, so sit back, relax, and watch your investment grow.

For each Unit Trust Fund we offer, our experts have set a strategy that’ll help it grow regardless of whether individual investors move in or out. The funds are professionally managed by CAL’s Unit Trust expert team comprising unit trust specialists plus high-caliber finance industry names, so you don’t have to individually monitor your different investments and can enjoy growth with

little effort.

CAL’s Unit Trust Expertise

Our clients have invested over 130Bn LKR invested in CAL Unit Trusts Funds and has been in operation since 2011 as a SEC registered Fund Manager, with our fund custodian being Hatton National Bank. Learn more about us.

What is a Unit Trust?

It’s the quickest path to a diverse investment portfolio that matches your life’s potential and aspirations.

A CAL Unit Trust is an easy opportunity for you to own top investment assets with lower capital and low involvement.

- Shares

- Treasury Bills

- Commercial Papers

- Bonds

- Debentures

- Securitized Papers

Unit Trust Resources

CAL constantly strives to offer valuable information to keen investors on everything Unit Trust related including the opportunity it presents. Here, we share a series of educational video resources on Unit Trusts.

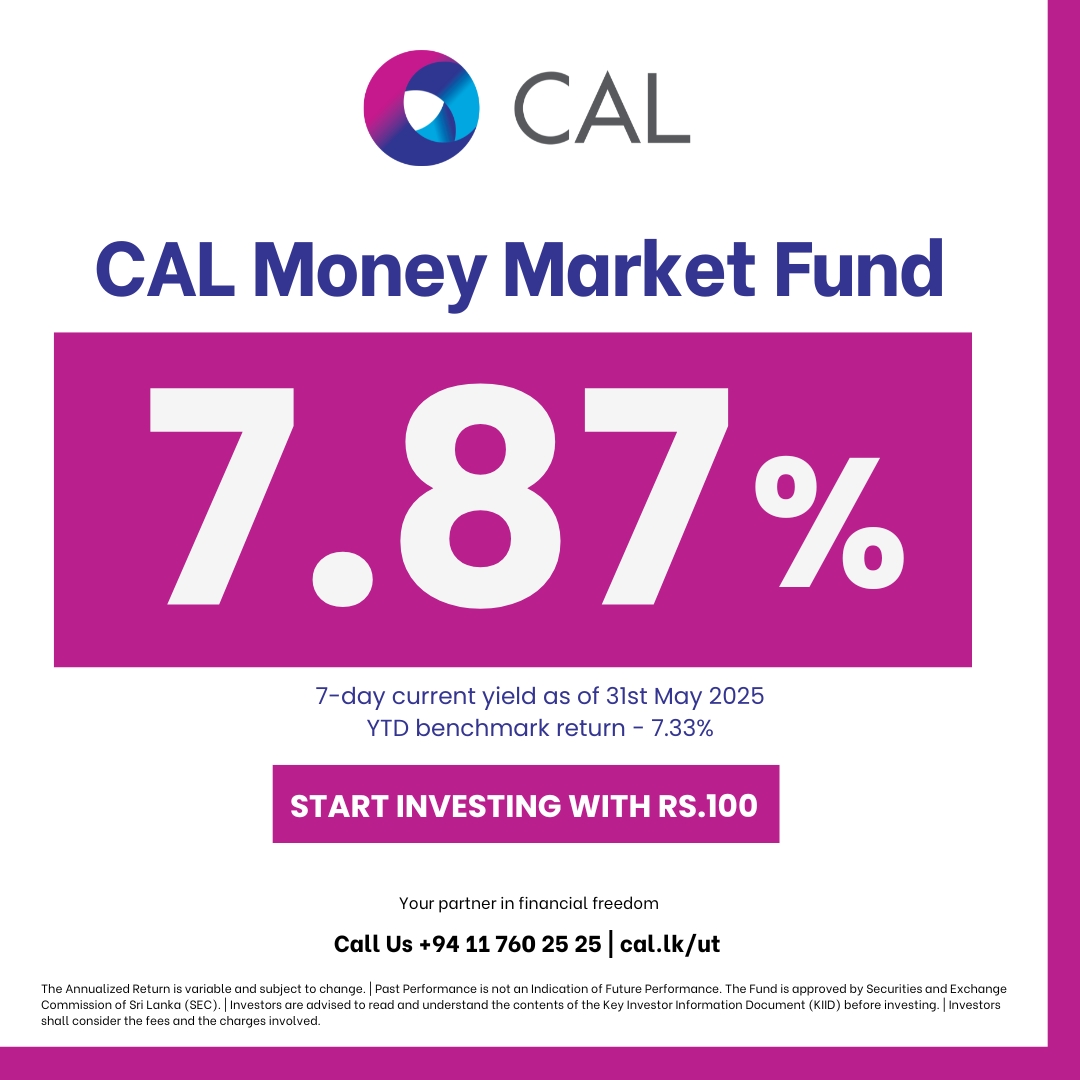

Discover CAL’s Top Unit Trust Funds

We offer a selection of Unit Trust Fund schemes that fulfill the unique needs of different investor types.

CAL Unit Holders’ Views

Hear what our Unit Trust holders have to say about CAL’s distinctness, the returns we help secure, and the life journey they’re charting.

CAL Unit Holders’ Views

Hear what our Unit Trust holders have to say about CAL’s distinctness, the returns we help secure, and the life journey they’re charting.

A Simple Unit Trust Example

A Unit Trust with LKR 500 Million total value offers units at LKR 250 each.

With LKR 50,000, you purchase 200 units (50,000 ÷ 250). The fund manager invests in a diversified portfolio.

The fund manager analyzes markets to select securities with growth potential, adjusting holdings based on economic conditions and performance. Unit prices rise when the underlying assets increase in value due to company profits, dividend payments, or market appreciation.

Six months later: Unit price rises to LKR 325.

- Your 200 units are now worth LKR 65,000 (200 × 325)

- Profit: LKR 15,000

This profit represents your share of the fund’s growth during your investment period.

Initial Investment

LKR 50,000Units Purchased: 200 units @ LKR 250 each

You are purchasing units instead of directly investing in assets.

Redemption Value

LKR 65,000New Unit Price: LKR 325

Your investment value increases as unit prices grow.

Profit

LKR 15,000Your gain reflects the overall fund growth.

Frequently Asked Questions

If you’ve understood that a Unit Trust is the perfect investment opportunity for you or you’re already a Unit Trust expert, sign up for the CAL Portal where you can start investing in Unit Trusts and our wider investment offering as well.

Ready for the next step?

Experience the Island’s Top Investor Portal!

Disclaimer Relating to Unit Trust Funds

We’ve included below a few considerations a potential unit trust fund investor should make when investing in unit trusts.

- – The fund is regulated by the Securities Exchange Commission (SEC).

- – The annualized YTD is variable and subject to change. The, past performance is not a definitive indication of future performance.

- – Investors are advised to read and understand the contents of the explanatory memorandum before investing.

- – The suitability of the investment is based on the investment objectives, financial situation and particular needs of individual investors and suitability should be assessed by the Investor.

Latest Prices and Downloads

Here, you can remain updated on the current unit prices of each fund whil also being able to download reports that’ll offer a view of the market plus relevant forms.