Sri Lankans Far and Wide Now Invest in Treasury Bills Due to Their Attractive Interest Rates and Flexibility

Treasury Bills have fast become a favorite investment option for Sri Lankans both at home and abroad, regardless of what they do and where they are in their investment journey. Here we share some of their investment experiences!

What Exactly Is a Treasury Bill?

Offered by the Central Bank of Sri Lanka to raise money for government operations, they’re similar to traditional deposits and will pay your interest at maturity.

Why Invest in Treasury Bills?

Great question! Treasury Bills offer a range of benefits similar to alternatives such as traditional deposits that make them attractive.

Why Invest Now?

Learn why many Sri Lankans are moving towards Treasury Bills and investing in them as we speak.

*Growth in outright secondary market transactions

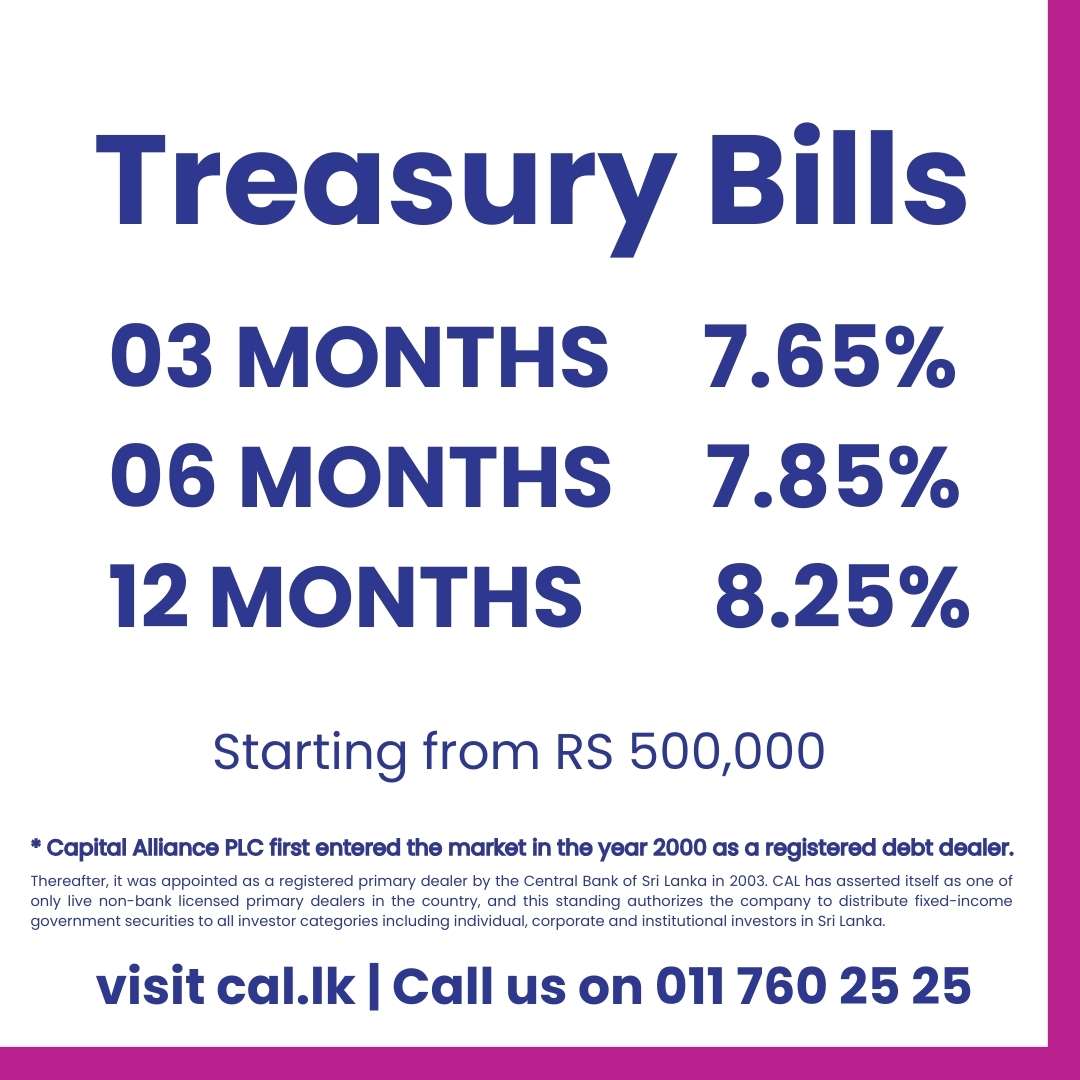

Why Choose CAL to Grow Your Wealth?

We’re a top-rated, licensed Primary Dealer offering some of the most competitive Treasury Bill interest rates in Sri Lanka and stellar service.