A unit trust is a pooled fund (contributions made by several investors) with common investment objectives. These pooled funds are then invested in a diversified portfolio of financial instruments such as bank and finance company deposits, corporate debt, shares, government securities etc. in order to earn a return.

The investors are allocated units in exchange for the funds they’ve invested and the return made by the pooled fund are allocated to these unit holders according to the number of units they own.

The most suitable fund for you to invest in, depends on how much of a risk you’re willing to take and your requirement to have cash/liquidity in hand Download Fund Fact Sheets

| Fund | Risk Appetite | Liquidity |

|---|---|---|

| Capital Alliance Investment Grade Fund | Low | Overnight |

| Capital Alliance Fixed Income Opportunities Fund | Medium | Medium term |

| Capital Alliance Income Fund | High | Long term |

| Capital Alliance High Yield Fund | High | Medium to Long term |

| Capital Alliance Quantitative Equity Fund | High | Long term |

| Capital Alliance Gilt Fund | Low | Long term |

Unit Trust returns vary based on market conditions and the performance of each fund. Please visit https://cal.lk/unittrust/calculator/to view the latest Unit Trust rates.

Please visit https://portal.cal.lk and register using your NIC/Passport number, valid mobile and email. There you will find the option to register for CAL Unit Trust Funds, see our Web Guide. Please have your NIC, recent Billing Address Proof (utility bill, bank statement etc) and recent Bank statement ready for a smooth signup.

Video Guide

You can follow the same process as above using our mobile App ‘CAL Online’ from the Apple App Store or Google Play Store.

You can view you investment fund portfolio, earning and your transaction history online through https://portal.cal.lk/

You can also submit your investment instructions (creations) and withdrawal instructions (redemptions) through the portal

Realized income subject toPersonal income tax.

5% on interest (WHT) paid by the UT fund can be offset against personal income tax.

CAL Investments is a licensed and registered by the Securities Exchange Commission (SEC) as an Investment Manager and Unit Trust Manager. The funds are regulated by the SEC and Deutsche Bank of Sri Lanka acts as the trustee and custodian ensuring that the SEC guidelines are adhered.

In order to ensure the safety of investor deposits, the Investment decisions are made via a well experienced investment committee which includes leading economists in the likes of Deshal De Mel and Shashika Ranasignhe. Click to view our Investment Committee. In addition, the Investment Grade Fund has been independently rated “Af(lka)” by Fitch Ratings and “[SL]A+mfs” by the International Credit Rating Agency. (ICRA)

However, it is noteworthy that unlike cash deposits in banks, unit trust funds are not protected by deposit insurance schemes. Therefore, the client bares the risk of not receiving their entire investment amount if the institutions the unit trust funds are invested in, face bankruptcy.

Yes, you may invest in any number of funds at the same time.

Please note these fees are charged to the fund and not the customer directly. The fund return is net of these fees.

| Details | Income Fund | Investment Grade Fund | High Yield Fund | *Quantitative Equity Fund | Fixed Income Opportunities fund |

|---|---|---|---|---|---|

| Management Fee | 0.50% | 0.75% | 0.75% | 1.50% | 0.50% per annum on the NAV |

| Custodian Fee | 194,400 p.a. | 194,400 p.a. | 240,000 p.a. | 240,000 p.a. | 240,000 p.a |

| Trustee Fee | 0.16% of NAV | 0.16% of NAV | 0.16% | 0.225% | 0.13% of NAV |

| Outperformance Fee | – | – | – | 10% | – |

It is to be noted that the returns published in the fund fact sheets and the website are net of fees.

Please note that unit creations/redemptions do not take place on Weekends, Poya, Mercantile and Bank Holidays. Therefore, unit creations can be done only on Weekdays and non- bank holidays, subject to our cut over times.

However, with our Instant Redemption feature, you can now redeem amounts up to LKR 50,000 instantly through the CAL app or CAL Online. This service is available 24/7, including weekends and holidays, ensuring that your funds are credited to your bank account immediately.

Click here to learn how to do your first investment

To do a fund Transfer (CEFT) under 5 million, please transfer to the below account;

| Capital Alliance Investments Ltd | 003010550558 |

You can also transfer directly to any of the below accounts to create units in a particular fund.

Please perform;

SLIP transfer for investment value below LKR 5 million

RTGS transfer for investment value above LKR 5 million

Transfer your investment to one of the accounts below and save the fund transfer confirmation.

Bank: Hatton National Bank PLC [Code – 7083, SWIFT Code – HBLILK LXXXX]

Branch Code – 003 [Head Office]

| Fund Name | Current A/C |

|---|---|

| CAL Fixed Income Opportunities Fund | 003010550451 |

| Capital Alliance High Yield | 003010550460 |

| Capital Alliance Investment Grade Fund | 003010550479 |

| Capital Alliance Medium Risk Debt Fund | 003010550488 |

| Capital Alliance Quantitative Equity Fund | 003010550497 |

| Capital Alliance Gilt Trading Fund | 003010550503 |

| Capital Alliance Corporate Treasury Fund | 003010550512 |

| Capital Alliance Balanced Fund | 003010550521 |

| Capital Alliance Gilt Money Market Fund | 003010550530 |

| Capital Alliance Gilt Fund | 003010550549 |

| Capital Alliance Income Fund | 003010550567 |

You’re required to enter the client code and/or NIC number in the beneficiary remarks field during the fund transfer and save the confirmation as a PDF or screenshot.

Please note that we do not accept/remit funds from/to third party accounts. Kindly ensure fund transfers take place from registered bank accounts under your unit trust client code.

Please do not hesitate to get in touch with us on 011 760 2525 for any further assistance.

In order to ensure timely completion of your fund transfer instructions, please ensure to visit the CAL Portal and perform a creation request after the transfer/s is/are completed.

Please refer to the fund transfer instruction guide for detailed instructions on how to proceed.

Please inform us of any investment instruction/s before 9.00 am via the portal for same day execution. For any investment instruction/s received after 9.00 am, we will execute same on the next working day.

Kindly note that we cannot accept funds from any third-party bank accounts.

You can also redeem/withdraw your funds and view your investment balance across Unit Trust Funds over time, through our Portal.

Please refer to the fund transfer instruction guide for detailed instructions on how to proceed.

Please inform us of any investment instruction/s before 9.00 am via the portal for same day execution. For any investment instruction/s received after 9.00 am, we will execute same on the next working day.

We are pleased to offer our Instant Redemption feature for added convenience. If the redemption amount is LKR 50,000 or below, you can transfer funds directly from your Unit Trust account to your bank account instantly using the CAL app or CAL Online, with the funds immediately available for use via your debit card.

Kindly note that we cannot remit funds to any third-party bank accounts.

Using the CAL Portal you can track Unit Creation requests. Once the request is made it will be shown as a Pending Transaction. If the funds have been successfully received and processed it will show as confirmed by the end of the work day.

You will receive a unit confirmation email on the following working day if the units have been successfully created.

Yes, you may do so if you provide a corresponding bank statement issued within the last 3 months or a screenshot/ image of the online banking portal or passbook. Share the respective documents via a request email to investments@cal.lk

Please note that funds will only be accepted from and remitted to bank accounts under the client/s name in accordance with AML guidelines stipulated by the Central Bank of Sri Lanka

Please transfer funds via RTGS if the transfer value is above LKR 5Mn and SLIPS if the value is below LKR 5Mn to ensure that funds are transferred successfully. Kindly avoid sending fund transfers via CEFT as there’s a possibility that the transfers will get reversed.

Yes, you can. You just have to fill in the Nomination form and hand it over to our CAL Head Office.

Download Fund Fact Sheets

Yes. The CAL Money Market Fund helps investors manage short-term cash through short-term financial instruments.

What does the fund invest in?

- Treasury bills and bonds from the Government of Sri Lanka

- Repurchase agreements (repos)

- Corporate debt rated AAA to BBB- by Fitch or Lanka Rating Agency (LRA)

All investments have maturities under 397 days.

Who is it for? Individuals or businesses seeking short-term cash management with reduced interest rate risk.

Key features:

- Instant redemption available

- Managed through CAL Online web or mobile app

Yes. The CAL Quantitative Equity Fund is an open-ended equity fund investing in the Colombo Stock Exchange.

What does the fund invest in?

- Listed shares on the Colombo Stock Exchange

- Government securities

- Government securities backed repos

Investment objective: Capital growth on a medium to long-term basis.

Risk profile: High risk. Returns depend on stock market performance and may be positive or negative.

Key features:

- No exit fees

- Unit prices vary daily based on transaction date.

- Higher volatility due to equity exposure

Who is it for? Investors with high risk appetite seeking long-term capital appreciation.

You may refer to the Fact sheet of Quantitative Equity Fund which is published on our website.

Refer Link: Quantitative Equity Fund

Please refer (Invest Management) to obtain the latest unit prices.

This decision solely depends on your risk appetite and at which stage you are in your personal financial cycle. The stock market is an investment opportunity for investors with high-risk appetite. Whereas fixed income unit trusts are in the low to medium risk spectrum offering above average returns for similar instruments across the financial market platform. It’s better option to earn superior returns with wealth preservation.

The rule of thumb in investing always calls for investors to diversify their investments in different asset classes.

Yes, please find attached the softcopies of the Unit Trust Onboarding documents for a Joint Account.

Note that the Primary and Joint applicant should fill in joint bank account details. We will also need the following source documents-

- Clear copy of Primary applicants NIC (front and back) with billing proof (only if address differs from NIC)

- Clear copy of Joint applicants NIC (front and back) with billing proof (only if address differs from NIC). If minor without NIC with birth certificate

- Bank account statement with the details (Bank, branch, account number) clearly visible – as mentioned it should be a joint bank account held by the Primary and Joint applicant

Yes, please find attached the softcopies of the Unit Trust Onboarding documents for a Corporate Account.

- Company secretary certified copies of Statutory Documents (Form 1 / 20 / 15 / Certificate of Incorporation)

- Company secretary certified copy of Articles of Association

- Certified copies of UBO’s / Directors’ / Authorized signatories NIC/PPs

Audited accounts (if available)

- Form 13 (if address differ from Form 1)

**As you do not need to maintain any minimum balance, we suggest ticking all the funds, to avoid unnecessary paperwork afterwards; it is completely up to you

***Needs to drill down to natural persons with equity interest of more than 10%. If the corporate client is owned by another body corporate (registered company), we will need the Holding Company’s Form 15 and the natural persons with equity interest of more than 10% mentioned.

ඒකක භාරයක් යනු පොදු ආයෝජන අරමුණු සහිත (ආයෝජකයින් කිහිප දෙනෙකුගේ දායකත්වයෙන් යුතු) සංචිත අරමුදලකි. මෙම සංචිත අරමුදල් ප්රතිලාභයක් ලබාගනු පිණිස බැංකු හෝ මූල්ය ආයතන තැන්පතු, ආයතනික ණය, සමාගම් කොටස්, සුරැකුම්පත් ආදී විවිධ මූල්ය උපකරණ ඔස්සේ ආයෝජනය කරනු ලැබේ.

ආයෝජනය කර ඇති අරමුදල් වෙනුවට ආයෝජකයින් හට ඒකක වෙන් කරනු ලබන අතර එක් එක් අයට හිමි ඒකක ගණන අනුව සංචිත අරමුදල මගින් ලැබෙන ප්රතිලාභය මෙම ඒකක හිමියන් සඳහා වෙන්කරනු ලැබේ.

ඔව්. බද්ධ ගිණුමක් සඳහා කරුණාකර අමුණා ඇති Unit Trust Onboarding ලේඛනවල මෘදු පිටපත් පිරික්සන්න.

මුල් අයදුම්කරු සහ බද්ධ අයදුම්කරු බද්ධ බැංකු ගිණුමට අදාළ විස්තර පිරවිය යුතු බව කරුණාවෙන් සලකන්න. අපට පහත දැක්වෙන මූලාශ්ර ලේඛනද අවශ්ය වනු ඇත:-

- මුල් අයදුම්කරුගේ ජාතික හැඳුනුම්පතේ පැහැදිලි පිටපතක් (ඉදිරිපස සහ පසුපස) සහ බිල්පත් සාක්ෂි (ජාතික හැඳුනුම්පතෙහි දැක්වෙන ලිපිනය වෙනස් වන්නේ නම් පමණි)

- බද්ධ අයදුම්කරුගේ ජාතික හැඳුනුම්පතේ පැහැදිලි පිටපතක් (ඉදිරිපස සහ පසුපස) සහ බිල්පත් සාක්ෂි (ජාතික හැඳුනුම්පතෙහි දැක්වෙන ලිපිනය වෙනස් වන්නේ නම් පමණි)

- ජාතික හැඳුනුම්පත නොමැති උප්පැන්න සහතිකය පමණක් ඇති බාල වයස්කරුවකු නම්, පැහැදිලි විස්තර (බැංකුව, ශාඛාව, ගිණුම් අංකය) සහිත බැංකු ගිණුම් ප්රකාශය – ඉහත සඳහන් කළ පරිදි එය මුල් අයදුම්කරු සහ බද්ධ අයදුම්කරු සතු බද්ධ බැංකු ගිණුමක් විය යුතුය.

ඔව්. ඔබට එසේ කළ හැක. ආයතනික ගිණුමක් සඳහා කරුණාකර අමුණා ඇති Unit Trust Onboarding ලේඛනවල මෘදු පිටපත් පිරික්සන්න.

සමාගම් ලේකම් විසින් සහතික කරන ලද ව්යවස්ථාපිත ලේඛනවල පිටපත් (ආකෘතිය 1 / 20 / 15 / සංස්ථාපන සහතිකය)

සමාගම් ලේකම් විසින් සහතික කරන ලද සමාගම් ව්යවස්ථාවේ පිටපත

UBO හි / අධ්යක්ෂවරුන්ගේ / බලයලත් අත්සන්කරුවන්ගේ ජා.හැ. පත්/විදේශ ගමන් බලපත්ර වල සහතික කළ පිටපත්

විගණනය කරන ලද ගිණුම් (තිබේ නම්)

ආකෘති පත්රය 13 (ආකෘති පත්රය 1 හි දැක්වෙන ලිපිනය වෙනස්වන්නේ නම්)

**අවම ශේෂයක් පවත්වා ගැනීමට අවශ්ය නොවන බැවින්, මතුවට අනවශ්ය ලේඛන කටයුතු වලක්වා ගැනීම සඳහා සියලුම අරමුදල් ඉදිරියේ හරි ලකුණ යොදන මෙන් අපි යෝජනා කරමු. සම්පූර්ණයෙන්ම එය ඔබට භාරයි.

***10% ට වඩා වැඩි කොටස් පොලියක් ඇති සැබෑ පුද්ගලයින් දක්වා දත්ත පිරික්සා බැලිය යුතු වේ. ආයතනික සේවාදායකයා වෙනත් ආයතනයක් (ලියාපදිංචි සමාගමක්) සතු වේ නම්, පරිපාලක සමාගමේ 15 ආකෘතිය සහ 10% ට වඩා වැඩි කොටස් පොලිය ඇති සැබෑ පුද්ගලයින් අපට අවශ්ය වනු ඇත.

ඔබට ආයෝජනය කිරීමට වඩාත්ම සුදුසු අරමුදල කුමක්ද යන්න ඔබ කොපමණ අවදානමක් ගැනීමට කැමතිද යන කරුණ සහ ඔබ සතුව මුදල්/ද්රවශීලතාව තිබීමේ අවශ්යතාවය මත පදනම් වේ. අරමුදල් තොරතුරු පත්රිකා බාගත කරගන්න.

| අරමුදල | අවදානම | ද්රවශීලතාව |

|---|---|---|

| Capital Alliance Investment Grade Fund | අවම | එදිනම |

| Capital Alliance Fixed Income Opportunities Fund | මධ්යස්ථ | මධ්ය කාලීන |

| Capital Alliance Income Fund | වැඩි | දීර්ඝකාලීන |

| Capital Alliance High Yield Fund | වැඩි | මධ්ය කාලීන සිට දීර්ඝ කාලීන |

| Capital Alliance Quantitative Equity Fund | වැඩි | දීර්ඝකාලීන |

| Capital Alliance Gilt Fund | අවම | දීර්ඝකාලීන |

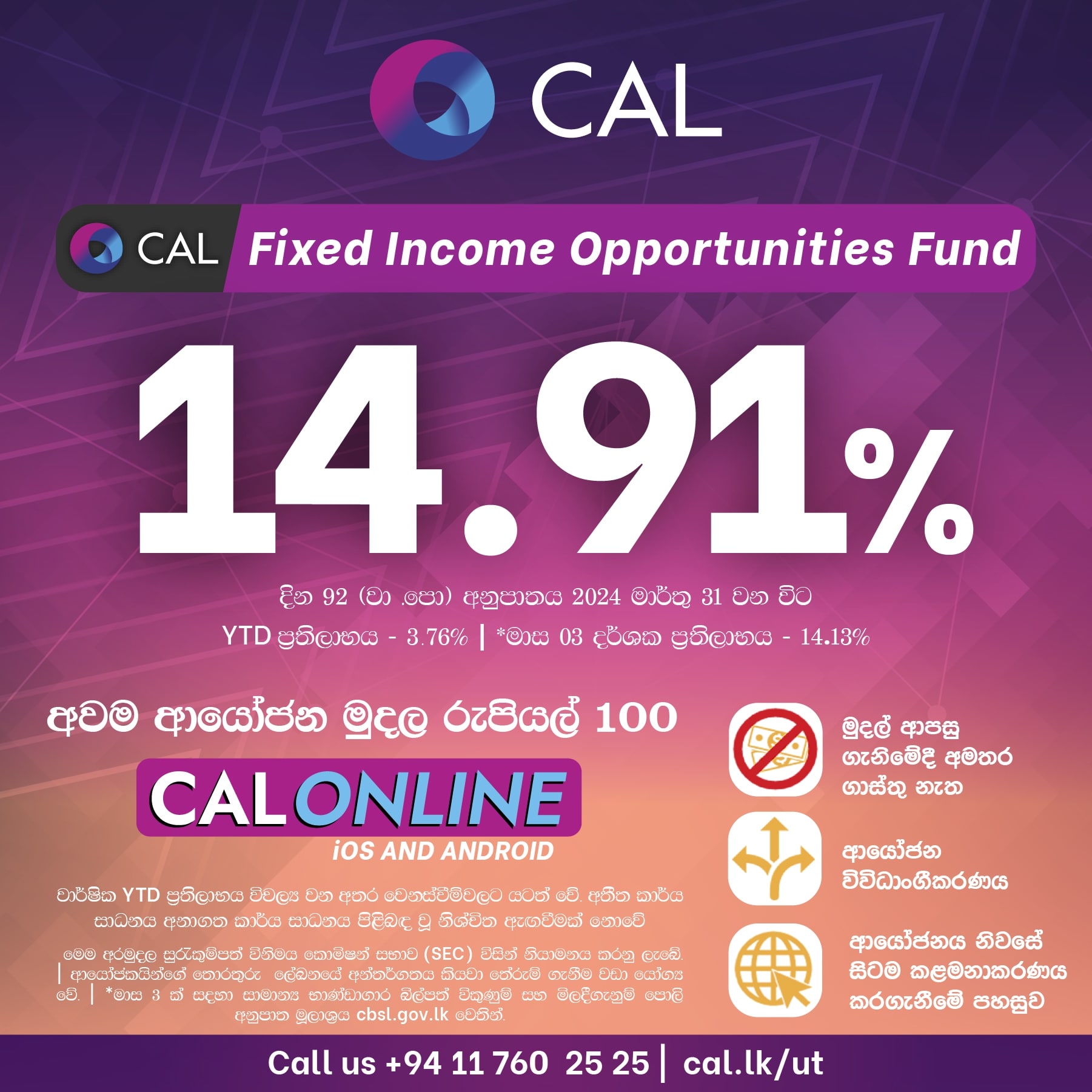

CAL Fixed Income Opportunities Fund සඳහා 2024/03/31 දිනට දින 92ක වාර්ෂික ප්රතිලාභය පහතින් උපුටා දක්වා ඇත. අනෙකුත් අරමුදල් විසින් වෙළඳපල තත්ත්වයන් සහ සාධනය මත පදනම්ව වෙනස්වන ඉපැයීම් ලබා ගනු ඇත. අතර ඒකක භාර ප්රතිලාභ වෙළඳපල අස්ථාවරත්වයට යටත් වන අතර, අතීත කාර්ය සාධනය අනාගත ප්රතිලාභ පිළිඹිබු කරන දර්ශකයක් නොවේ.

කරුණාකර visit https://portal.cal.lk වෙත පිවිස ඔබගේ ජා.හැ. පත් අංකය/විදේශ ගමන් බලපත්ර අංකය, වලංගු ජංගම දුරකථන අංකය සහ විද්යුත් තැපෑල යොදා ලියාපදිංචි වන්න. එහිදී ඔබට CAL Unit Trust Funds සඳහා ලියාපදිංචි වීමේ සබැඳිය සොයා ගත හැකි වනු ඇත. අපගේ වෙබ් අඩවි මාර්ගෝපදේශයද බලන්න. පහසුවෙන් ලියාපදිංචි කරගැනීමට කරුණාකර ඔබගේ ජාතික හැඳුනුම්පත, මෑත කාලීන බිල්පත් ලිපින සාක්ෂි (උපයෝගිතා බිල්පත්, බැංකු ප්රකාශය ආදිය) සහ බැංකු ප්රකාශය සූදානම් කර ගන්න.

වීඩියෝ මාර්ගෝපදේශය

ඔබට ඇප්ප්ලෙ Apple App Store හෝ Google Play Store වෙතින් අපගේ ජංගම යෙදවුම වන ‘CAL Online’ යෙදවුම ලබාගෙන එය භාවිතයෙන් ඉහත ක්රියාවලිය අනුගමනය කළ හැක.

ඔබට ඔබගේ ආයෝජන අරමුදල් කළඹ, ඉපැයීම් සහ ඔබේ ගනුදෙනු ඉතිහාසය https://portal.cal.lk/ හරහා දැකබලාගත හැකිවනු ඇත

ඔබට මෙම පිවිසුම හරහා ඔබගේ ආයෝජන උපදෙස් (සැකසීම) සහ මුදල් ආපසු ගැනීමේ උපදෙස් (මුදවාගැනීම්) ද ඉදිරිපත් කළ හැකිවනු ඇත.

CAL Investments යනු සුරැකුම්පත් විනිමය කොමිෂන් සභාව (SEC) යටතේ ආයෝජන කළමණාකරුවකු සහ ඒකක භාර කළමණාකරුවකු ලෙස ලියාපදිංචි කරන ලද බලපත්රලාභී ආයතනයක් වේ. එහි අරමුදල් සුරැකුම්පත් හා විනිමය කොමිෂන් සභාව විසින් නියාමනය කරනු ලැබේ. එහි භාරකාරිත්වය ශ්රී ලංකා ඩොයිෂ් බැංකුව විසින් දරනු ලබන අතර මෙමගින් සුරැකුම්පත් හා විනිමය කොමිෂන් සභාවේ මාර්ගෝපදේශ පිළිපදින වග සහතික කරනු ලැබේ.

ආයෝජක භවතුන්ගේ තැන්පතු වල සුරක්ෂිතභාවය සහතික කිරීම උදෙසා ආයෝජන පිළිබඳ තීරණ ගනු ලබන්නේ දේශාල් ද මෙල්, ශෂිකා රණසිංහ වැනි ප්රමුඛ පෙළේ ආර්ථික විද්යාඥයින්ගෙන් සමන්විත ඇතුළත් මනා පළපුරුද්දකින් හෙබි ආයෝජන කමිටුවක් විසිනි. මෙම සබැඳිය මගින් අපගේ ආයෝජන කමිටුව දැකගත හැක. මීට අමතරව, Investment Grade Fund ස්වාධීනව “Af(lka)” Fitch ශ්රේණිගත කිරීම් මගින් ස්වාධීනව “Af(lka)” ලෙසත් ජාත්යන්තර ණය ශ්රේණිගත කිරීම් නියෝජිතායතනය (ICRA) විසින් “[SL]A+mfs” ලෙසත් ශ්රේණිගත කර ඇත.

කෙසේ වෙතත්, බැංකුවල සිදුකෙරෙන මුදල් තැන්පතු මෙන් නොව, ඒකක භාර අරමුදල් තැන්පතු රක්ෂණ ක්රම මගින් ආරක්ෂා නොවන බව සැලකිය යුතුය. එමනිසා ඒකක භාර අරමුදල් ආයෝජනය කර ඇති ආයතන බංකොලොත් භාවයට මුහුණ දෙන අවස්ථාවකදීම සේවාදායකයින් හට ඔවුන්ගේ සම්පූර්ණ ආයෝජන මුදල නොලැබීමේ අවදානම පවතියි.

ඔව්. ඔබට එකවර ඕනෑම අරමුදල් ගණනක ආයෝජනය කළ හැකිය.

| විස්තර | Income Fund | Investment Grade Fund | High Yield Fund | *Quantitative Equity Fund | Gilt Fund |

|---|---|---|---|---|---|

| කළමනාකරණ ගාස්තුව | 0.50% | 0.75% | 0.75% | 1.50% | 0.5% |

| භාරකාරත්ව ගාස්තුව (වාර්ෂිකව) | 194,400 | 194,400 | 240,000 | 240,000 | 240,000 |

| භාරකාර ගාස්තුව | 0.16% of NAV | 0.16% of NAV | 0.16% | 0.225% | 0.16% |

| ඉහළ කාර්යසාධන ගාස්තුව | – | – | – | 10% | – |

අරමුදල් තොරතුරු පත්රිකාවල සහ වෙබ් අඩවිය ඔස්සේ ප්රකාශයට පත් කර ඇති ප්රතිලාභ ශුද්ධ ගාස්තු යන වග සැලකිය යුතුය.

නවතම ඒකක මිල ලබා ගැනීමට කරුණාකර (ආයෝජන කළමනාකරණය) වෙත යොමු වන්න.

ඒකක සකසාගැනීම්/මුදවාගැනීම් සති අන්ත දින, පෝය දින, වෙළඳ සේවා සහ බැංකු නිවාඩු දිනවල සිදු නොවන බව කරුණාවෙන් සලකන්න. එබැවින්, ඒකක ආරම්භ කළ හැක්කේ සතියේ දිනවල සහ බැංකුවලට අදාළ නොවන නිවාඩු දිනවල වැඩ කරන වේලාවන්වලට යටත්ව පමණි.

කෙසේ වෙතත්, අපගේ Instant Redemption විශේෂාංගය සමඟින්, ඔබට දැන් CAL APP හෝ CAL Online හරහා රුපියල් 50,000ක් දක්වා මුදල ක්ෂණිකව ලබා ගත හැක. මෙම සේවාව සති අන්ත සහ නිවාඩු දින ඇතුළුව 24/7 ලබා ගත හැකි අතර, ඔබගේ අරමුදල් වහාම ඔබගේ බැංකු ගිණුමට බැර වන බව සහතික කරයි.

ඔබේ පළමු ආයෝජනය කරන්නේ කෙසේදැයි දැන ගැනීමට මෙතැන ක්ලික් කරන්න

මිලියන 5ට අඩු අරමුදල් හුවමාරුවක් (CEFT) කිරීමට කරුණාකර පහත ගිණුමට මාරු කරන්න;

| Capital Alliance Investments Ltd | 003010550558 |

යම් අරමුදලක ඒකක සෑදීම සඳහා ඔබට පහත ඕනෑම ගිණුමකට කෙලින්ම මාරු කළ හැකිය.

කරුණාකර ඉටු කරන්න;

රුපියල් මිලියන 5ට අඩු ආයෝජන වටිනාකමක් සඳහා SLIP හුවමාරුව

රුපියල් මිලියන 5ට වැඩි ආයෝජන වටිනාකමක් සඳහා RTGS මාරු කිරීම

Transfer your investment to one of the accounts below and save the fund transfer confirmation.

Bank: Hatton National Bank PLC [Code – 7083, SWIFT Code – HBLILK LXXXX]

Branch Code – 003 [Head Office]

| Fund Name | Current A/C |

|---|---|

| CAL Fixed Income Opportunities Fund | 003010550451 |

| Capital Alliance High Yield | 003010550460 |

| Capital Alliance Investment Grade Fund | 003010550479 |

| Capital Alliance Medium Risk Debt Fund | 003010550488 |

| Capital Alliance Quantitative Equity Fund | 003010550497 |

| Capital Alliance Gilt Trading Fund | 003010550503 |

| Capital Alliance Corporate Treasury Fund | 003010550512 |

| Capital Alliance Balanced Fund | 003010550521 |

| Capital Alliance Gilt Money Market Fund | 003010550530 |

| Capital Alliance Gilt Fund | 003010550549 |

| Capital Alliance Income Fund | 003010550567 |

අරමුදල් මාරු කිරීමේදී ඔබ සේවාලාභී කේතය සහ/හෝ ජාතික හැඳුනුම්පත් අංකය ප්රතිලාභී ප්රකාශ ක්ෂේත්රයේ ඇතුළත් කර තහවුරු කිරීම PDF හෝ තිර රුවක් ලෙස සුරැකීමට අවශ්ය වේ.

අපි තෙවන පාර්ශ්ව ගිණුම් වලින්/ වෙත අරමුදල් භාර නොගන්නා බව කරුණාවෙන් සලකන්න. ඔබගේ ඒකක භාර සේවාදායක කේතය යටතේ ලියාපදිංචි බැංකු ගිණුම් වලින් අරමුදල් මාරු කිරීම් සිදු වන බව කරුණාවෙන් සලකන්න.

වැඩිදුර සහාය සඳහා කරුණාකර 011 760 2525 අංකයෙන් අප හා සම්බන්ධ වීමට පසුබට නොවන්න.

ඔබේ අරමුදල් මාරුකිරීමේ උපදෙස් නියමිත වේලාවට සම්පූර්ණ කිරීම සහතික කිරීම සඳහා, මාරුකිරීම සාක්ෂාත් වූ පසු කරුණාකර CAL පිවිසුම වෙත යෑම හා සකසාගැනීම සඳහා ඉල්ලීමක් කිරීම සහතික කරන්න.

මින් මතුවට පිළිපැදිය යුතු ආකාරය පිළිබඳ සවිස්තරාත්මක උපදෙස් සඳහා කරුණාකර අරමුදල් මාරුකිරීම් උපදෙස් මාර්ගෝපදේශය වෙත ඔබගේ අවධානය යොමු කරන්න.

ඕනෑම ආයෝජන උපදෙසක් එදිනම ක්රියාත්මක කිරීම සඳහා පෙ.ව. 9.00 ට පෙර පිවිසුම හරහා එය පිළිබඳව අපට දන්වන්න. පෙ.ව. 9.00 න් පසු ලැබෙන ඕනෑම ආයෝජන උපදෙසකට අදාළ දේ ඊළඟ වැඩ කරන දිනයේදී අපි ක්රියාත්මක කරන්නෙමු.

කිසිඳු තෙවන පාර්ශවයක බැංකු ගිණුමකින් අරමුදල් භාර ගැනීමට අපට නොහැකි බව කරුණාවෙන් සලකන්න.

ඔබට අපගේ පිවිසුම ඔස්සේ ඕනෑම ඒකක භාර අරමුදල්වල තැන්පත් කර ඇති ඔබගේ අරමුදල් මුදවාගැනීමට/ආපසු ගැනීමට සහ කලින් කලට ආයෝජන ශේෂය දැකබලාගැනීමට හැකිය.

මින් මතුවට පිළිපැදිය යුතු ආකාරය පිළිබඳ සවිස්තරාත්මක උපදෙස් සඳහා කරුණාකර අරමුදල් මාරුකීරිම් උපදෙස් මාර්ගෝපදේශය වෙත ඔබගේ අවධානය යොමු කරන්න.

ඕනෑම ආයෝජන උපදෙසක් එදිනම ක්රියාත්මක කිරීම සඳහා පෙ.ව. 9.00 ට පෙර පිවිසුම හරහා එය පිළිබඳව අපට දන්වන්න. පෙ.ව. 9.00 න් පසු ලැබෙන ඕනෑම ආයෝජන උපදෙසකට අදාළ දේ ඊළඟ වැඩ කරන දිනයේදී අපි ක්රියාත්මක කරන්නෙමු.

අමතර පහසුව සඳහා අපගේ Instant Redemption විශේෂාංගය පිරිනැමීමට අපි සතුටු වෙමු. මුදාගැනීමේ මුදල LKR 50,000 හෝ ඊට අඩු නම්, CAL App හෝ CAL Online භාවිතයෙන් ක්ෂණිකව ඔබේ Unit Trust ගිණුමෙන් ඔබේ බැංකු ගිණුමට අරමුදල් මාරු කළ හැකිය, ඔබේ හර කාඩ්පත හරහා භාවිතය සඳහා වහාම ලබා ගත හැකි අරමුදල් සමඟ.

කිසිඳු තෙවන පාර්ශවයක බැංකු ගිණුමකින් අරමුදල් භාර ගැනීමට අපට නොහැකි බව කරුණාවෙන් සලකන්න.

CAL පිවිසුම යොදාගනිමින් ඔබට ඒකක සකස්කර ගැනීම සඳහා වන ඉල්ලීම් නිරීක්ෂණය කළ හැක. ඉල්ලීම කළ පසු එය සකස්කරමින් පවතින ගනුදෙනුවක් ලෙස පෙන්වනු ලැබේ. අරමුදල් සාර්ථකව ලැබී ඇත්නම් සහ සකස් කිරීම සිදුවී ඇත්නම් වැඩ දිනය අවසානයේදී එය තහවුරු කළ බව පෙන්වනු ලැබේ.

ඒකක සාර්ථකව සකස්කර ඇත්නම්, ඔබට ඊළඟ වැඩ කරන දිනයේදී ඒකක තහවුරු කිරීම පිළිබඳව විද්යුත් තැපෑලක් මගින් ඔබව දැනුම්වත් කෙරේ.

ඔව්. පසුගිය මාස 3 තුළ නිකුත් කරන ලද බැංකු ප්රකාශයක් හෝ සබැඳි බැංකු පිවිසුමේ හෝ ගිණුම් පොතේ ඡායාරූපයක්/තිරරූපයක් ඔබට ලබා දිය හැකිනම් එසේ කිරීමට ඔබට හැකියාවක් ඇත. Investment@cal.lk යන ලිපිනය වෙත විද්යුත් තැපෑලක් හරහා අදාළ ලේඛන යැවිය යුතුය.

ශ්රී ලංකා මහ බැංකුව විසින් නියම කර ඇති AML මාර්ගෝපදේශයන්ට අනුකූලව ගනුදෙනුකරුවන්ගේ නමින්ම ක්රියාත්මක වන බැංකු ගිණුම්වලින්/ගිණුම්වලට පමණක් අරමුදල් පිළිගනු ලබම/ප්රේෂණය කරනු ලබන බව කරුණාවෙන් සලකන්න.

සාර්ථකව අරමුදල් මාරුකීරිම් සිදුවන බව සහතික කරගැනීම සඳහා මාරු කිරීම් අගය රුපියල් මිලියන 5ට වැඩිනම් RTGS මගින්ද අගය රුපියල් මිලියන 5ට අඩුනම් SLIPS මගින්ද අරමුදල් මාරුකීරිම් කළ යුතු වේ. අරමුදල් මාරුකිරීම් ආපසු හැරවීමට ඉඩ ඇති බැවින් CEFT හරහා අරමුදල් මාරු කිරීම් සිදුකිරීමෙන් වළකින්න.

ඔව්. ඔබට එසේ කළ හැක. ඔබ විසින් කළ යුත්තේ නාමයෝජනා ආකෘති පත්රය පුරවා එය අපගේ CAL ප්රධාන කාර්යාලයට භාර දීම පමණි.