It’s been a month of volatility with local markets reacting to tensions in the Middle East. The primary concerns centered on the potential flow-through to oil import prices and the vulnerability of our tea exports, considering roughly half of these shipments are destined for that region. Local equity markets were more reactive than the bond markets, with notable fluctuations in reaction to overnight news. The exchange rate also weakened with the spot rate breaching the LKR 300/USD mark (+0.7% since the start of tensions), prompted by concerns around the current account balance if oil prices were to significantly rise to USD 100/bbl, which could have meant approximately a USD 1 bn increase in the country’s annual import bill (c.5% increase in the import bill).

However, with the ceasefire in effect, worries have subsided, the exchange rate has pulled back and equity markets are running, while g-sec yields are now back at their lowest levels since the economic crisis three years ago.

Lower rates to continue; eyes on inflation projections

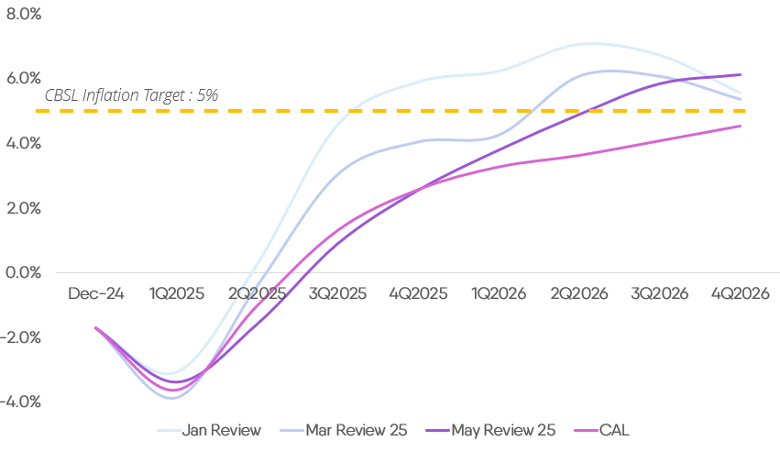

The key question for interest rates is whether the CBSL has concluded its easing cycle, or if we can expect more rate cuts down the line. This really hinges on when inflation will sustainably hit that 5% target.

We’ve seen several administrative price reductions, particularly for fuel and electricity, contributing to deflation over the past 10 months. However, in the absence of money printing and slower-than-anticipated domestic credit growth (more on this shortly), demand driven inflation has been slow to kick in. This is reflected in core inflation, averaging at 1.5% over the past 12 months. All of this has meant that inflation projections keep falling short of the 5% target – resulting in the Bank’s call to cut policy rates to achieve this.

Chart 1: Inflation Projections

Based on CAL’s inflation projections, we think there’s still a possibility for the Central Bank to revise its inflation forecasts further downwards. This is especially true if the ceasefire in the Middle East continues to help keep oil prices low globally. However, whether they choose to provide another stimulant could depend on how credit picks up too – although there is no explicit objective around this by the bank under the inflation targeting monetary framework.

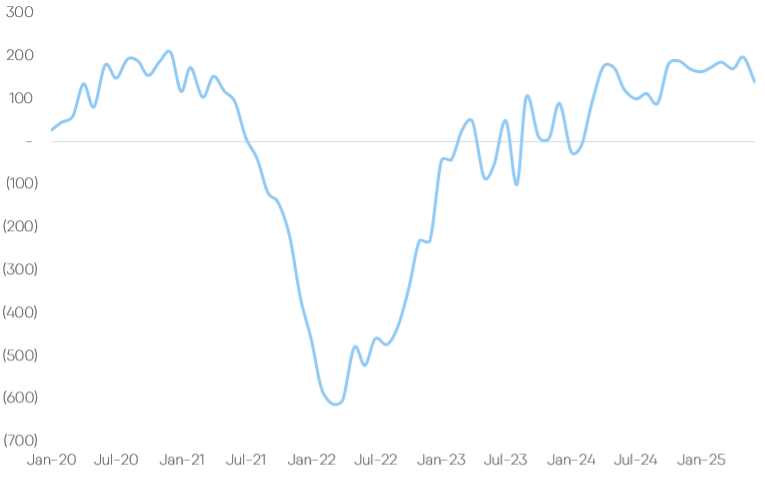

Overall, we anticipate that downward pressure on interest rates will persist. This is supported by over LKR 120 bn in excess liquidity in the system and the availability of the significant LKR 1.4 tn cash buffer to mitigate any unexpected market swings.

That said, lower interest rates are a strong positive for the fiscal deficit and lower cost deficit financing. In conjunction with an LKR 469 bn reported primary surplus in 1Q, slowly reducing interest payments will help achieve medium term fiscal targets.

Chart 2: Month End Overnight Liquidity (LKR Bn)

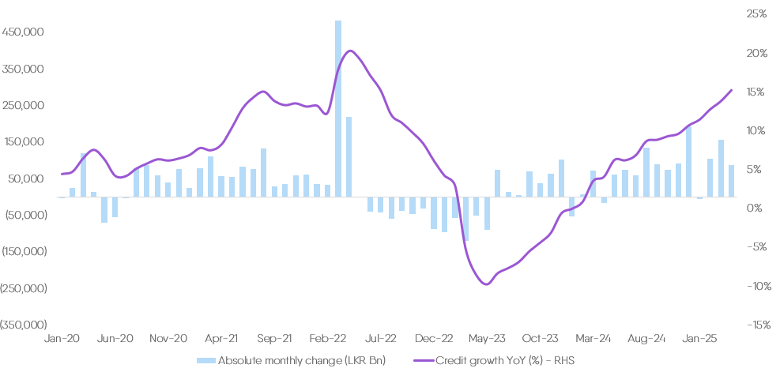

Economic Expansion Gains Pace, Credit Set for More

On the credit front, we’ve seen private sector lending grow steadily over the past year, up by 15% YoY up to April 2025. While the Central Bank considers this pace “healthy,” our own conversations with local banks suggest they were hoping for a slightly faster pick-up. It’s fair to say that those initial tariff scares and Middle East tensions likely weighed a bit on demand, but most banks are quite optimistic about seeing higher credit growth moving forward. With rates coming down, banks also need to start lending more aggressively to cushion pressure on Net Interest Income.

Looking at credit as a % of M2b indicates that we are still at least 30-40% lower in monthly disbursements compared to past credit growth cycles, so we still have a way to go before things heat up and require any policy change by the central bank. In fact, this ample room for growth extends to the broader GDP picture. 1Q GDP came in strong at 4.8%, following a 5% growth in 2024, and we continue to expect c.4-4.5% growth in 2025E. Key sectors contributing to this growth include Construction, up 10.7% YoY, and Services (+2.8% YoY), aided by increased trade activity and impressive numbers in tourism. In 2025, we expect tourism arrivals to hit very close to the peak numbers last seen in 2018.

Notably, c.25-30% of the credit growth observed in 1Q2025 came from overseas lending as banks utilized excess dollar funds set aside during the ISB restructure to lend to overseas projects, particularly in India.

Chart 3: Credit to the Private Sector

Progress on IMF program, Board approval pending

This past month brought positive news with the approval of the Staff Level Agreement with the IMF. This indicates that Sri Lanka has successfully fulfilled all its objectives for the third review – with the final hurdle of a 15% increase in electricity tariffs going into effect from June 1st. The upward impact on inflation is broadly contained, with inflation reporting at -0.6% for the month. More crucially, this tariff adjustment should enable to the Ceylon Electricity Board to return to profitability on a monthly basis.

All that’s left for the disbursement is the IMF Board Approval, expected to come in July. If everything stays on schedule, the next review will be in the fourth quarter of 2025, which can unlock a total of c. USD 1 bn in funding from the IMF for this year, which should help build up reserves comfortably past the USD 7.1 bn end-year IMF target.

Chart 4: Gross Official Reserves (USD Bn)

All in all, on the domestic front, most indicators are looking quite strong right now. The main overhang remains global risks, specifically the looming tariff deadline and any potential for further escalation in Middle East tensions. So, staying vigilant on external shocks and ensuring consistent policy implementation will be crucial for sustaining this recovery and steering the economy towards its long-term growth potential.

Disclaimer

This document has been prepared and issued on the basis of publicly available information, internally developed data and other sources, believed to be reliable. Capital Alliance Securities (Private) Limited however does not warrant its completeness or accuracy. Opinions and estimates given constitute a judgment as of the date of the material and are subject to change without notice. This report is not intended as a recommendation or as an offer or solicitation for the purchase or sale of any financial instrument. The recipient of this report must make their own independent decision regarding any securities, investments or financial instruments mentioned herein. Securities or financial instruments mentioned may not be suitable to all investors and Capital Alliance Securities (Private) Limited does not have the information to assess such suitability. Capital Alliance Securities (Private) Limited its directors, officers, consultants, employees, outsourced research providers associates or business partner, will not be responsible, for any claims damages, compensation, suits, damages, loss, costs, charges, expenses, outgoing or payments including attorney’s fees which recipients of the reports suffers or incurs directly or indirectly arising out actions taken as a result of this report. This report is for the use of the intended recipient only. Access, disclosure, copying, distribution or reliance on any of it by anyone else is prohibited and may be a criminal offence.