Election uncertainty amps up; fiscal policy first on the chopping block

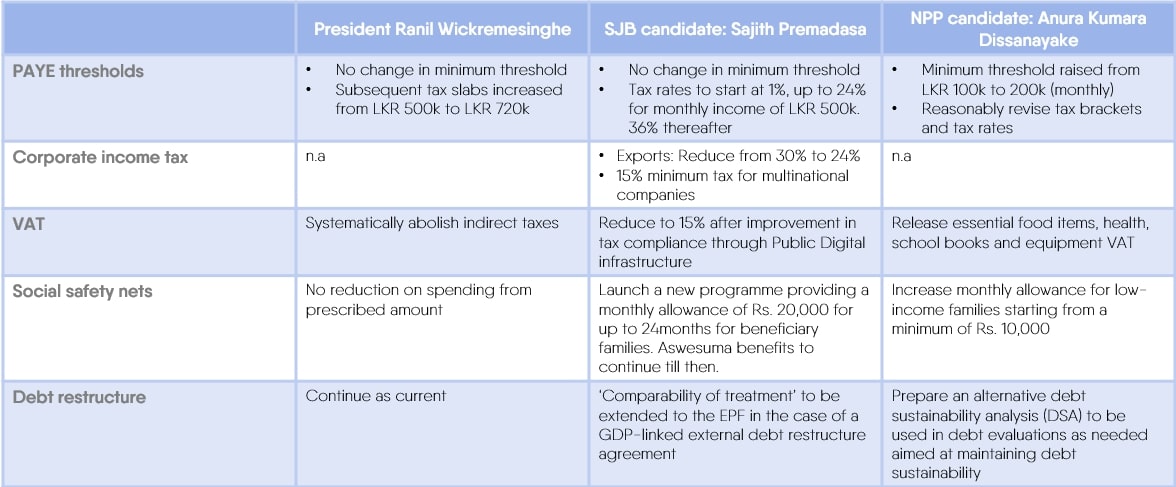

With less than a month left for the Presidential election, uncertainty is at a high. The three leading candidates have unveiled their manifestos, promising variations of changes to tax policy, from changes in PAYE tax bands to tax exemptions on essential goods. All in all, the deviations from the broader fiscal policy framework appear manageable, and everyone seems to be on board with continuing with an IMF agreement, leaving some wiggle room to renegotiate on specific targets.

What seems to be making a larger dent on the fiscal side right now is the recent approval of a wage hike for public sector employees and increases in fertilizer subsidies, which are estimated to add LKR 350 – 400 Bn to government expenditure from 2025E (c. 1 – 1.2% of GDP). This means that larger capital expenditure may continue to be muted if we are to achieve the IMF primary surplus target of 2.3% of GDP in 2025E, diminishing medium term growth potential. The good news is that treasury cash buffers are still strong and the Government has already exceeded to the 2024 primary surplus target in the first half, achieving c. 1.6% of GDP against an end-year target of 0.8% – which could make financing the deficit easier.

Table 1: Summary of Fiscal and debt policy based on published manifestos

Note: This is not a comprehensive list of published proposals and includes items related to key tax and expenditure categories, and statements with regards to the IMF agreement pertaining to the debt restructure

Equity markets spooked; Bond market activity dries up

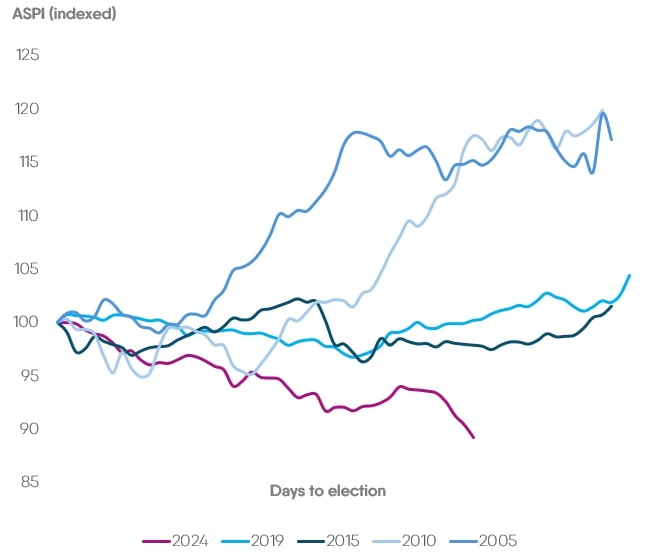

Equity markets appeared to have switched gears, from a “wait and see” stance last month to much more fear. This sentiment has led to a index decline of 4% in the market since the start of the month. The Banking sector index (currently the largest contributor to the index) has dropped 7.8% in two weeks despite earnings coming in strong in the June quarter.

Taking a look at the ASPI’s movements in Presidential election cycles over the past 20 years, its quite clear that “this time is different”, with this being the steepest downtrend prior to elections and market turnover taking a continued hit.

What’s different? Here’s what we think:

- This time the presidential race is split 3-ways and highly contested. Prior to this, it’s only been a 2-horse race.

-

This is the first election after an economic crisis of this magnitude in the country’s history.

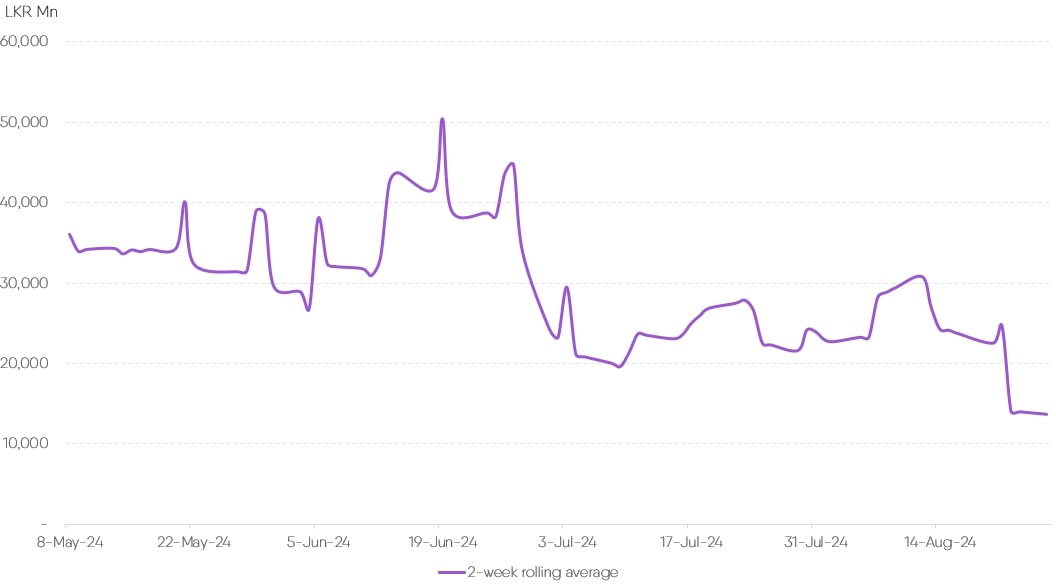

Volumes in the bond market have also thinned out, with rates remaining elevated. The central bank also cancelled an upcoming bill auction and reduced the quantum of the September bond auction, touted to be the largest bond auction in the country’s history (albeit by LKR 10bn) as a strong message that it can wait out this uncertainty using its cash buffers.

Chart 1: ASPI performance prior to a Presidential election

Chart 2: Secondary bond market volumes (two-week rolling average)

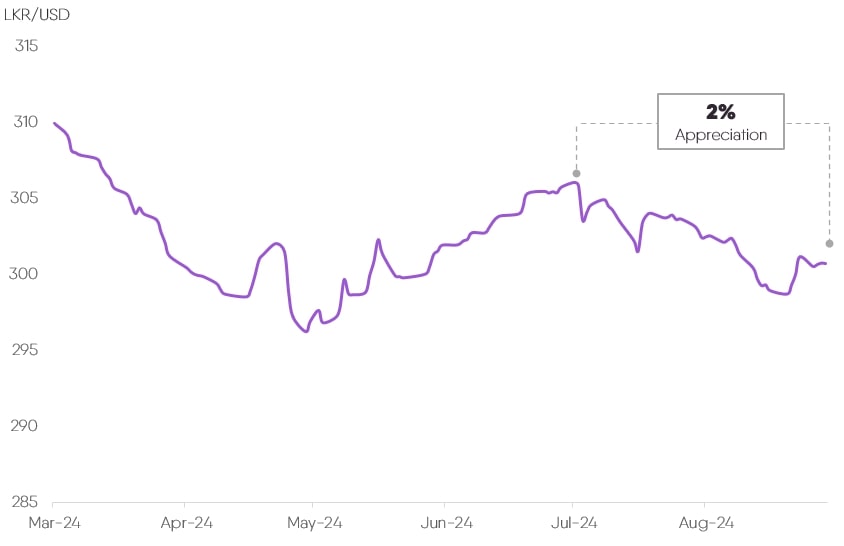

External Debt Restructure delayed; LKR stable: It’s been almost 2 months since the initial agreement with the private bondholders. Radio silence on the matter since then seems to indicate that finalization of the agreement is likely to be delayed again, to post-election. The worry here is that everyone could be back at the negotiation table, potentially reshaping the repayment structure and delaying the IMF review and subsequent tranche.

On the plus side, continued strong FX inflows has given the rupee a slight boost in recent weeks. With debt repayments on hold, this stronger rupee could stick around through the end of the year.

We are now tilted to the lower end of our LKR 310 to 320 range (against the USD) by year-end. While we anticipate a surge in imports driven by commercial vehicle imports and election-related spending, the robust tourism season and steady flow of remittances will help mitigate depreciatory pressures.

Chart 3: Movement of LKR against USD

Tourism boom is a-go: Seemingly unfazed by the election cycle, the tourism sector is thriving, looking forward to a strong Winter season. Based on our chats with hotel and tour operators across the island, they see arrivals hitting all-time highs come December. There is currently also a benefit being seen into Sri Lanka from a shift in Indian tourist preferences away from the Maldives due to geopolitical concerns.

September is set to be a crucial month. Key dates to watch include:

- September 15: Largest bond auction of LKR 290 Bn

- September 20: Monetary Policy Review

- September 21: Presidential Election

As we enter the final countdown to the election, the air is thick with uncertainty. Markets are jittery, fiscal policies are in question, and everyone’s waiting to see what happens next. With everything from market swings to a booming tourism season in play, how this all shakes out will be something to watch closely. The stakes are high, but for now, it’s a waiting game.