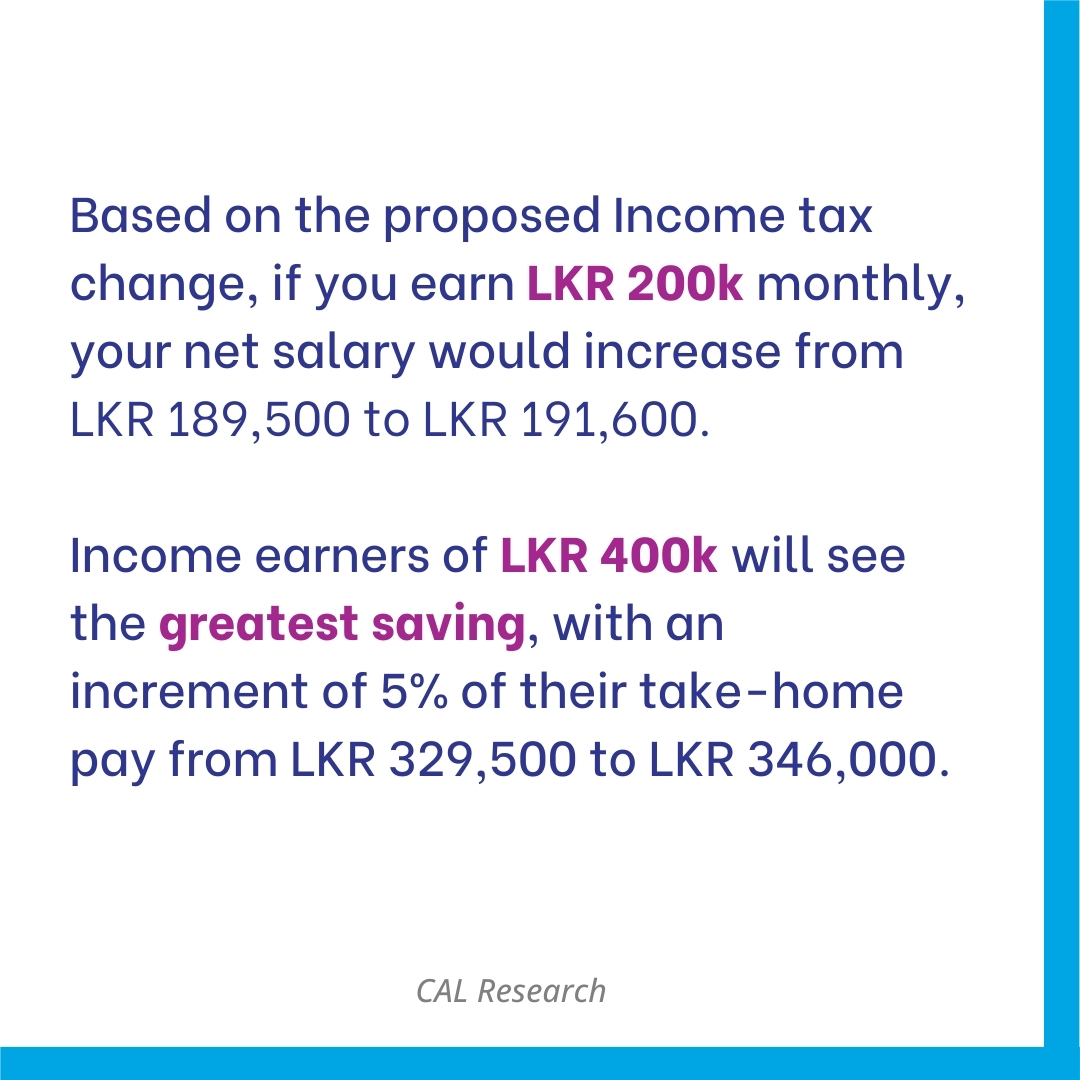

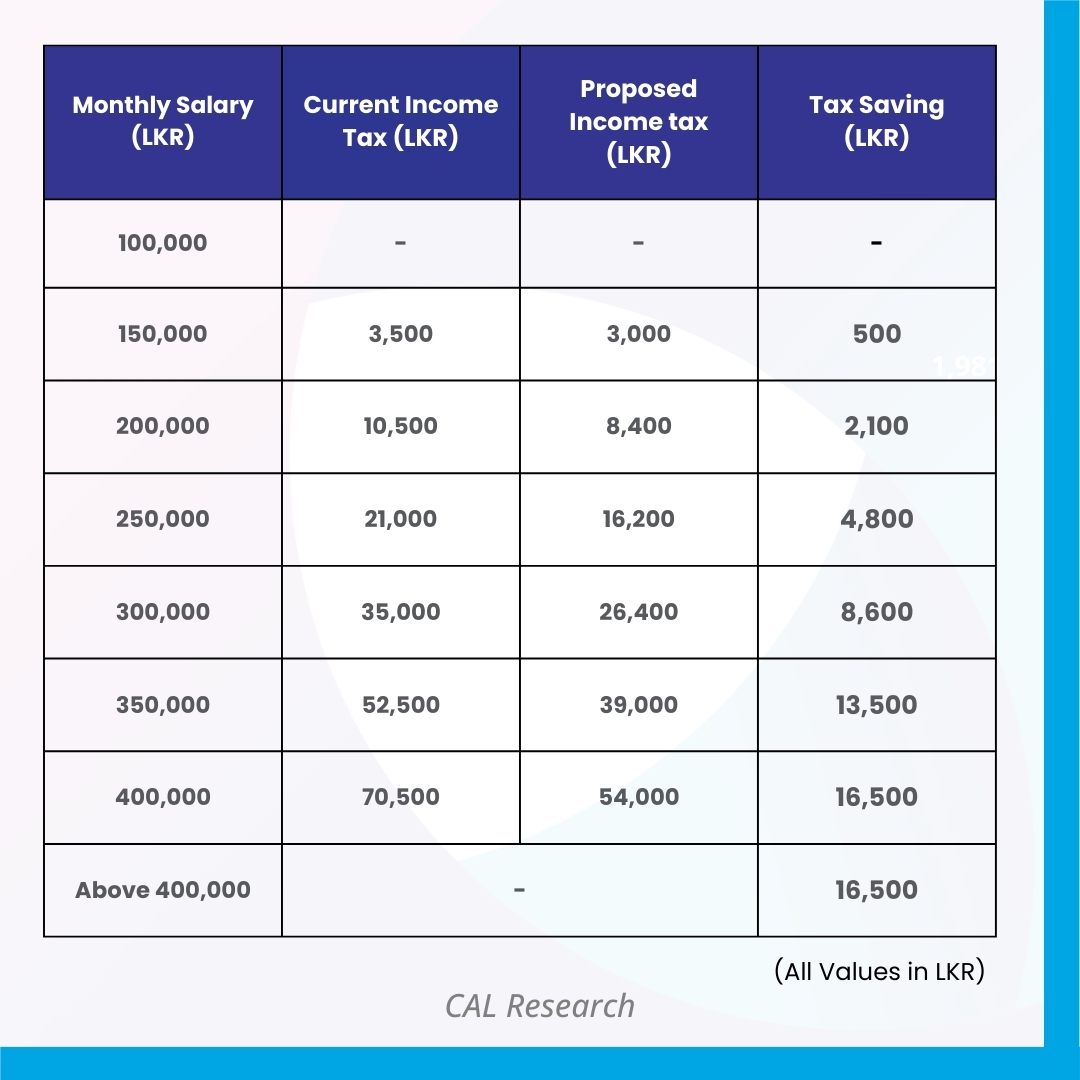

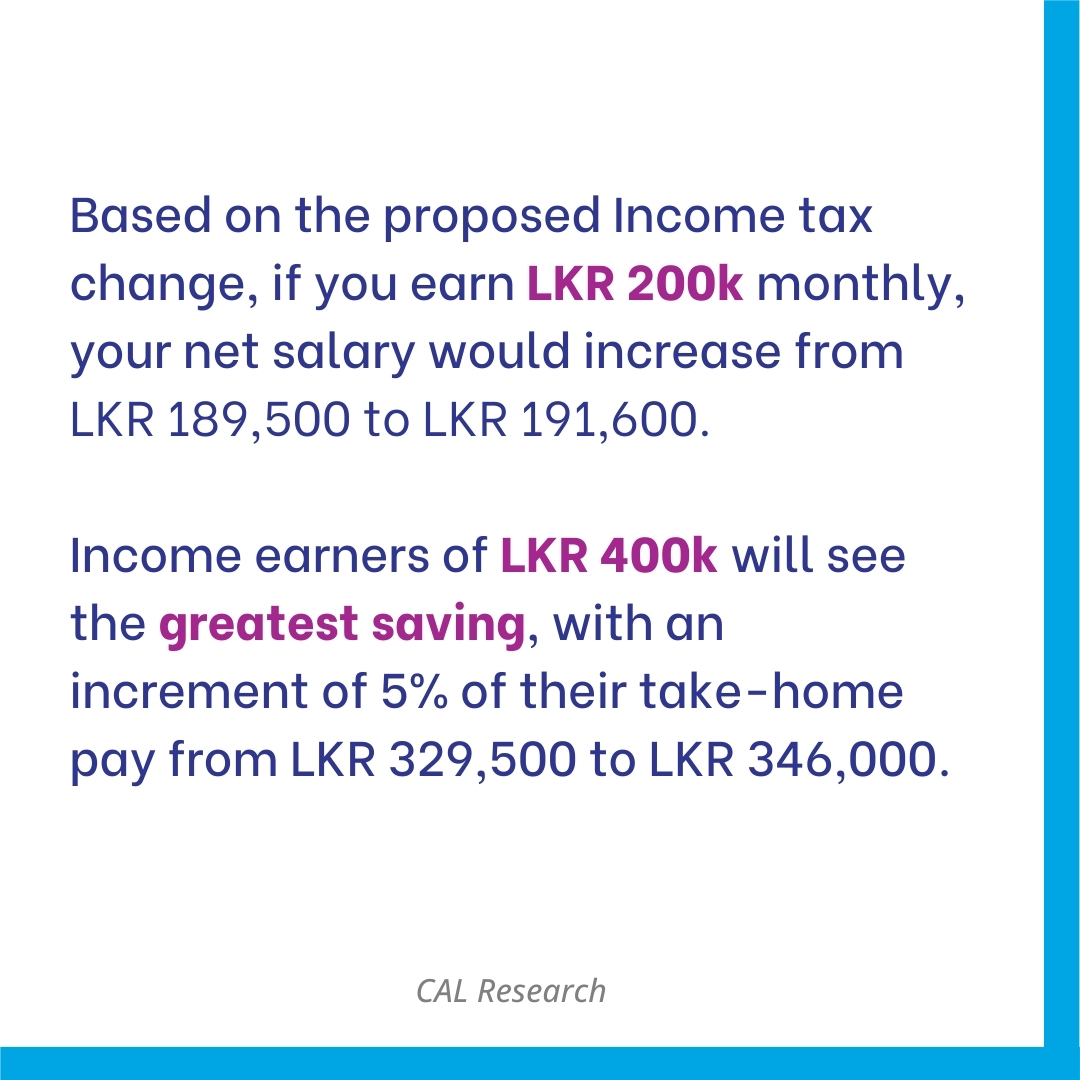

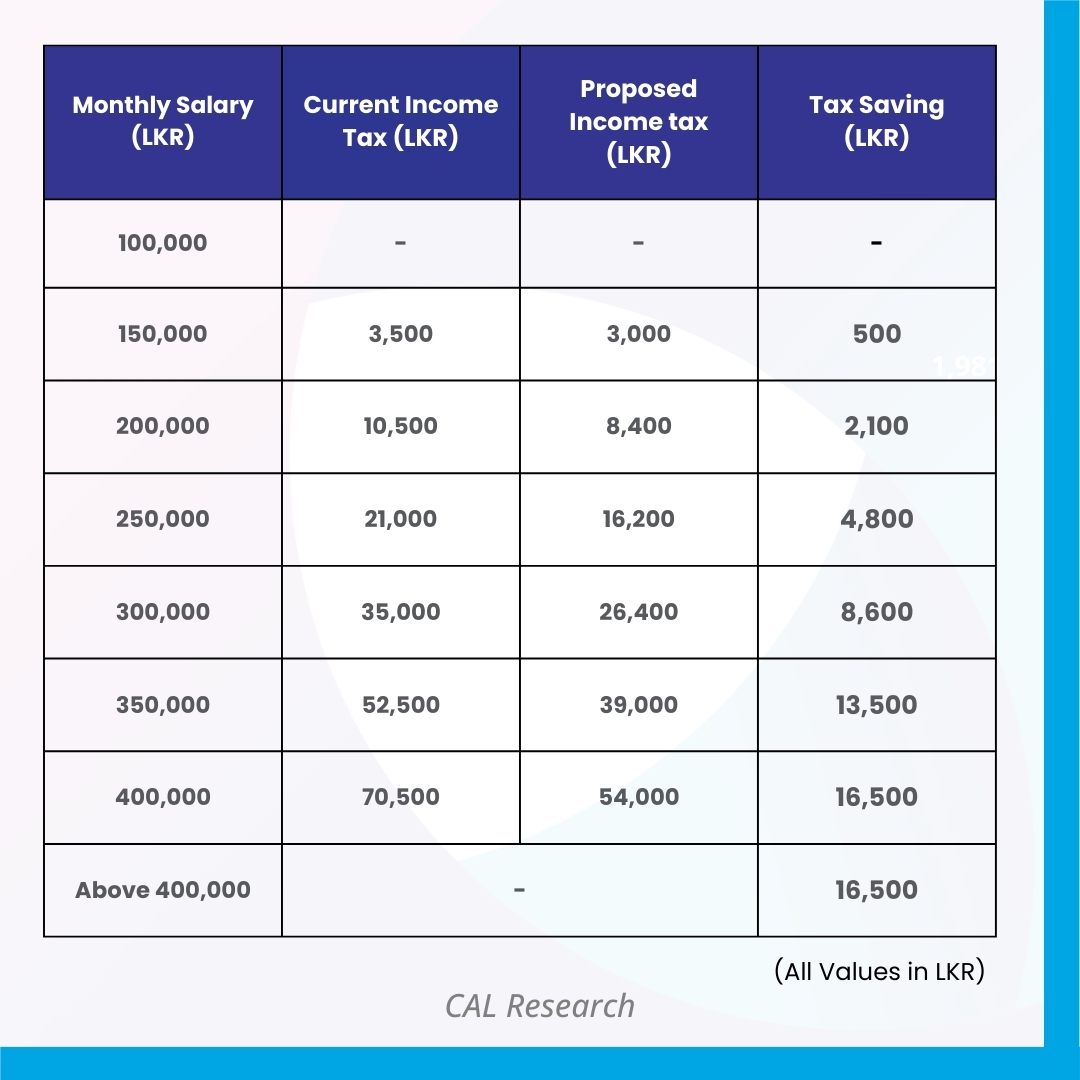

From April 2025, updated tax rates will result in higher take-home pay. For those earning LKR 200k, your net salary will increase from LKR 189,500 to LKR 191,600. Income earners of LKR 400k will see a 5% increase, from LKR 329,500 to LKR 346,000.

From April 2025, updated tax rates will result in higher take-home pay. For those earning LKR 200k, your net salary will increase from LKR 189,500 to LKR 191,600. Income earners of LKR 400k will see a 5% increase, from LKR 329,500 to LKR 346,000.