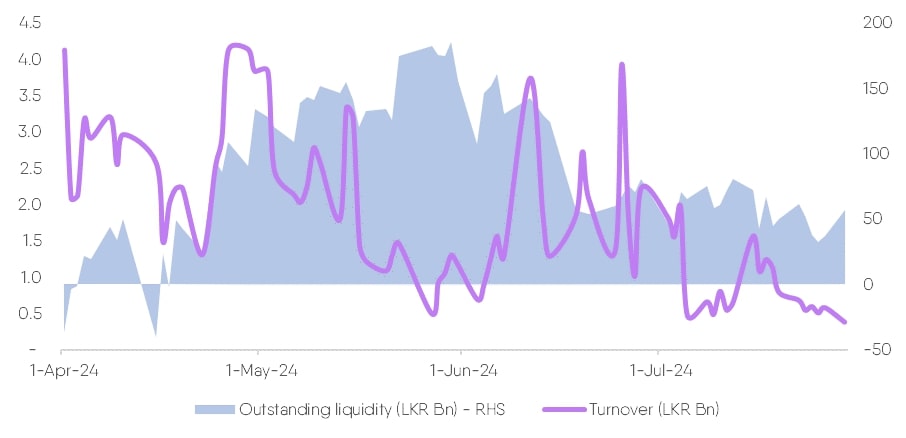

Elections dry up market liquidity: The date is set – 21st September is officially when Sri Lanka will be hitting the polls to vote for its President. The incumbent president, Ranil Wickremesinghe is seeking re-election, facing competition from key candidates such as left-wing Anura Kumara Dissanayake and centrist Sajith Premadasa. With mixed views on the election outcome, the market’s response has been cautious. Liquidity in both debt and equity markets has notably decreased and is likely to remain constrained until the election concludes.

We think there are very few impactful policy changes any one candidate can make to change the current course proposed by the IMF, at least in the short term. However, the uncertainty has led many market participants to adopt a “wait and see” approach.

Chart 1: Outstanding market liquidity vs CSE Turnover

External debt restructuring reaching the finish line: The big news which hit earlier this month is the nearing completion of the external debt restructuring (EDR). This has been a long and arduous process, but it seems we’re finally reaching the finish line. The haircuts and losses we’re seeing are largely in line with our expectations of a 52% NPV loss* in the base case scenario, and most banks seem prepared to weather the storm, having already set aside enough money to cover the potential losses. However, the big question mark is how they’ll handle the accounting for these changes, especially when it comes to Macro-linked Bonds. With negotiations with the Official Creditor Committee also closing in, the one that remains to be heard is on USD 2.1 Bn outstanding debt with the China Development Bank. We expect the finalization of the debt deal to be concluded prior to the elections, as delaying it beyond that could mean entering a whole new round of negotiations based on the elected candidate.

*Assuming a 28% principal haircut on existing bonds, maturity extension of 5 years, coupon reduction of c.25% and an exit yield of 12%

Table: NPV loss based on CAL’s estimates

| Scenario | Nominal GDP USD Bn (avg. 2025-2027) | Principal haircut (excluding PDIs) | Average coupon post 2028 | NPV loss estimated (excl. consent fee) |

|

GDP Threshold #1

|

100

|

15%

|

8.2%

|

38%

|

|

GDP Threshold #2

|

96

|

15%

|

7.2%

|

42%

|

|

GDP Threshold #3

|

92

|

20%

|

6.6%

|

47%

|

| IMF Baseline |

88.6

|

28%

|

6.3%

|

52%

|

| Threshold below baseline #1 |

86.7

|

35%

|

6.3%

|

55%

|

| Threshold below baseline #2 |

84.7

|

40%

|

6.3%

|

58%

|

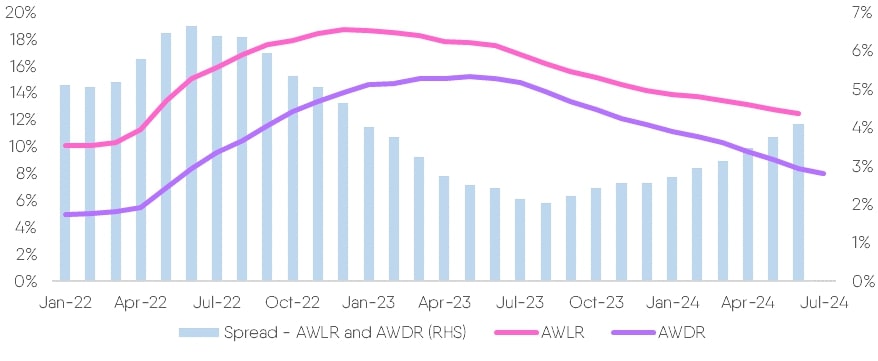

CBSL delivers a further policy rate cut: The Central Bank of Sri Lanka (CBSL) has taken a cautious approach with a 25 basis point rate cut. While this signals their intent to continue easing monetary policy, they’re also putting pressure on banks to pass on these cuts to borrowers. It’s a clear message that they want to see credit flowing through the economy. Looking at the numbers, we’ve seen a pretty steep drop in the Average Weighted Deposit Rate (AWDR) this year, down 382bps, however, the Average Weighted Lending Rate (AWLR) has been slower to adjust, reducing by 174bps YTD. New loans are still hovering close to 12% levels.

In the secondary government securities market, rates barely reacted to the policy rate reduction, in fact the long end has edged up since then as investors move towards a shorter investment horizon along with the announcement of the election. Fundamentally, interest rates should ease, however, the uncertainty in the air will likely keep it sticky on the way down.

The rate cut aims to boost credit growth, but banks might be hesitant to adjust lending rates too aggressively. They’re likely focused on maintaining their profit margins (NIMs) for the time being. Additionally, businesses are hesitant to invest and expand until we have a clearer political picture, which may keep credit growth somewhat contained in the very near term.

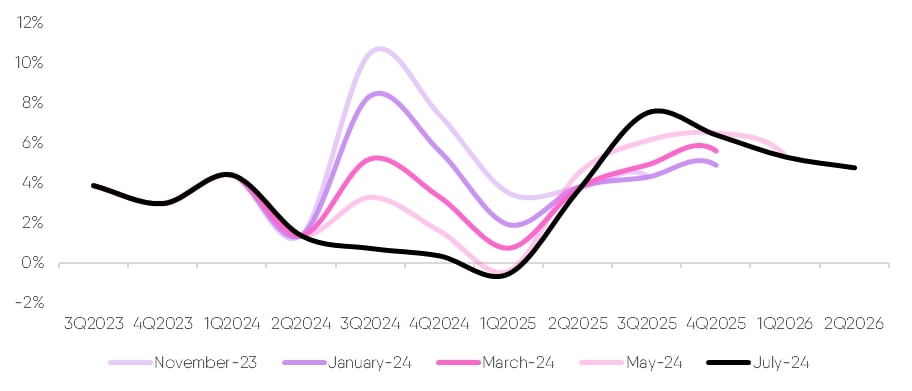

Chart 2: Spread between AWLR and AWDR

Dipping into deflation territory: Sri Lanka is no longer talking about just slowing inflation, we’re now talking about deflation. This is largely on account of administrative price reductions with an accumulated 43% reduction in electricity tariffs so far this year. With demand conditions slow to pick up, we’re looking at inflation turning negative possibly as early as September, and thanks to negative base effects, it appears this low inflation could stick around till at least 1Q2025. At the moment, the Central Bank expects deflation to hit early next year, although it’s useful to keep in mind that their projections have continued to be lowered over consecutive policy reviews in the past.

Chart 3: CBSL Inflation Projections

Revival on the ground: In recent on-the-ground developments, we spoke with folks in the construction industry. While they’ve seen some price reductions on materials like cement, demand is still sluggish. However, there’s a flicker of hope. The industry is optimistic that a finalized EDR will unlock new sources of funding, both from bilateral partners and foreign investors. This could breathe life back into stalled projects and potentially inject USD 2.5 Bn into the sector (based on industry experts). We’ve just recently seen the ADB unlocking USD 100mn in loans for power sector reforms and Japan has already conveyed its decision to resume disbursements to Yen Loan projects which had been paused since the default.

Meanwhile, the apparel industry is finally seeing a turnaround. Textile and apparel manufacturers are reporting a dramatic increase in their order books for next quarter, a sign that exports are on the upswing. The sector reported a 4% YoY growth in exports in June, only the second time it reported a growth in the past 21 months.

Tourism bookings are also holding steady, even with elections looming, surpassing 1 million tourists by June, standing at c.87% of tourists seen in 2018 (pre-Easter Attacks) for the first half of the year. The East coast, from Arugam Bay to Trincomalee, in season at this time of year is bustling with tourists, with barely any rooms available in the beachfront hotels for most of August and September already.

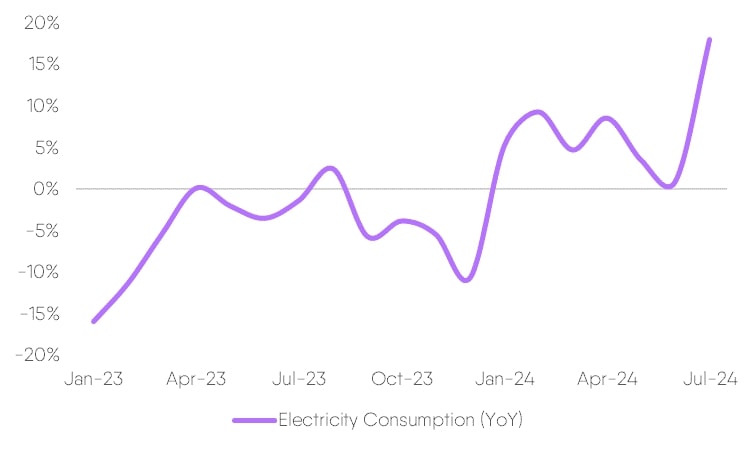

Economic activity is definitely on an upswing, electricity consumption is up 18% YoY so far this month, overall payment transaction volumes have risen 27% in the second quarter, trade is strong with import and export volume indices increasing 15.6% and 11.3% YoY up to May and… the traffic has certainly heightened.

Given all this, we are confident that GDP growth will realize within 3.5 – 4% in 2024E.

Chart 3: Electricity Consumption (YoY)

Exchange rate pressure points gather in 2H2024E: The outlook for the Sri Lankan Rupee (LKR) remains mostly unchanged at LKR 310 to 320 (against the USD) by year-end. We expect it to stay near the upper end of the trading range, although September could see some pressure with USD 724mn in debt service outflows including USD 225mn in a consent fee. The good news is that the Government has built buffers to weather this. Thereafter, some pressure could be added from a phased reopening of the vehicle import market in the fourth quarter and the expectation of high credit growth driving consumer and investment goods imports.

Speaking of vehicles, the lifting of the import ban has caused a surge in activity on platforms like Ikman (think Sri Lanka’s version of eBay) for the second-hand vehicle market. Electric vehicles seem to be all the rage, but questions about taxes and market prices are keeping some buyers on the fence.

Sri Lanka is definitely on the mend. The EDR is nearing completion, key export sectors are performing well, and tourism remains resilient. The big question on everyone’s mind and (what we hope to be) the last hurdle of “uncertainty” is the upcoming election. Markets may be quiet until a winner becomes clearer but we are optimistic of the trajectory after.