My first experience with the Colombo Stock Market was at the age of twenty-two. In hindsight, my attempts at investing in the stock market were foolhardy and fraught. At that time, my principles for trading were, if share prices were increasing, I should buy, without understanding the behavior of the market. If my memory serves me right, I made some trades and incurred loses that were considerable, upwards of 60% of the investments.

When I started investing, I raised capital by borrowing from my mother, a teacher and my brother. I was able to gather Rs 200,000. I was determined to earn a large return on investment and repay my borrowings while working towards my financial freedom. With the benefit of hindsight, and better information available today, I know I made two bad decisions. They are every equity investor’s enemies;

One; is borrowing to invest.

Two; is expecting a higher return from a shorter period.

To this day it still baffles me that I never showed the same enthusiasm, investing on a fixed deposit which provides a guaranteed return, although admittedly is lower return and over a longer duration.

Having been an investment professional for a considerable number of years and having gained more expertise, I wonder if I have truly mastered the “psychological game of trading”, and the honest response to that is; No. My firm belief is that if we cannot control our emotion, sooner we will find ourselves out of the market.

It was Warren Buffet who said, “Be fearful when others are greedy and greedy when others are fearful”. The success of an investment would depend on putting this theory into practice. If shares of a company are acquired at rock bottom prices, there are two likely outcomes;

- The company goes into administration

- Stock growth with healthy returns

Whenever I look at a share trading graph, I always look at post-war (2009-2011) returns and tell myself, if I did trade during those times, I would probably have made millions. The present economic crisis may offer a similar opportunity for investors who can perfectly time the market entrance and exit.

Finally, should we stay out of the share market during this financial crisis? The answer may well depend on the risk appetite.

At any moment, if you decide to take the risk and invest in the stock market, it is worth looking at the quadruple frameworks highlighted by Warren Buffet in his 2007 AGM letter.

Buying a business, you understand: This could be a company with a single product or operating in an understandable business segment (example, a company selling candy). Unless you have patience and significant knowledge interpreting financial statements, you will find yourself lost trying to understand the annual report of a conglomerate or a finance company.

Favorable long-term economics: As per Buffet, an extraordinary business must have an enduring “moat” that protects the return on capital employed. Capitalist dynamics guarantee that competitors, again and again, assault any business that procures exceptional yields. Consequently, an effective barrier, such as being a low-cost producer (Chinese manufacturers) or having a powerful brand (McDonald’s) is essential. A moat that must be recreated continuously will not be a moat by any means. An extraordinary CEO is an enormous resource for any business. However, this doesn’t inform, much regarding the company’s future. At the point when the specialist goes, the moat of the company will go. In a steady industry long-term, competitive advantage is what, Buffet search for in a business.

Capable and reliable management: Public limited companies are where shareholders lend money to the management with the hope of getting a higher return in the future. Often, the shareholders have never met the management. So how does the legal body ensure that these shareholders’ investment is protected? It is through, the corporate governance system. However, corporate governance alone will not provide 100% protection. It will, however, help to minimize the risk of default. By selecting companies that strictly adhere to the corporate governance principles, you may be able to achieve this.

A sensible price tag: This is where I would like to refer Benjamin Graham’s “Net-Net Working Capital” (NNWC) strategy. Which states that we buy companies which are trading below its working capital, the meaning of this is, that the market fails to give credit to its property plant and equipment (PPE).

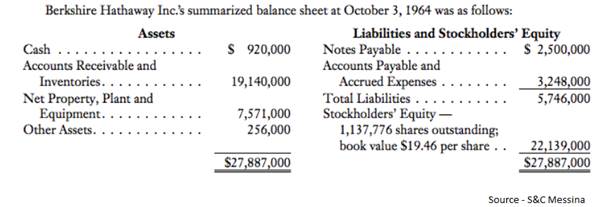

For illustration purpose, I have included the balance sheet of Berkshire Hathaway as of 1964, a significant acquisition of Warren Buffet in 1965 with an average price of USD 14.9 per share.

If you take a closer look at this snapshot, the total additions of cash, accounts receivables and Inventories were USD 20.6mn. After deducting total liabilities of USD 5.7mn, a share is worth USD 13.1 per share according to the Net-Net Working Capital strategy. In hindsight, Buffet had purchased this company at proximity to its NNWC, paying USD 2.1mn to buy the Property Plant and Equipment worth USD 7.6mn.

Senthilmani Thuvarakan – Research