“Whilst economies are preparing for one of the worst ever years in history, we see stock markets keep climbing, some even recording their highest growth in years; be it developed or developing markets. Stock markets are known to be forward-looking which underpins the current perception among many investors that there will be a “quick recovery” following a disastrous second-quarter economic performance.

I intend to discuss two key observations of the above statements through this article.

- Stock markets keep climbing? Let’s dig deep into this.

Investor confidence: A rallying stock market is a reflection of growing investor confidence. What made investors suddenly become confident of the market when one of history’s devastating pandemic is at its peak? Undoubtedly, measures taken by governments unlike at the 2008 financial crisis were a key catalyst. Governments and Central Banks were willing to do whatever it takes to not let the economy fall into recession (if you would like to read a summary on measures taken by each country, this would be a good read — Link). On a separate note, I do believe the bitter experience investors had with the 2008 financial crisis which occurred as a result of inefficient government roles made investors overact forcing the S&P 500 to take a beating at the inception of the current pandemic.

Liquidity infusion resulting in market uptick: Intervention of Government/CB is a double-edged sword. Just as much as it brings investor confidence; it results in investors being overly reliant on central bank actions and forgetting the fundamentals. Though Central banks print money, the market decides where it should go. Measures such as quantitative easing allows money to flow into assets such as bonds and equity. The inevitable consequence of this would be the stock market rising in a crashing economy.

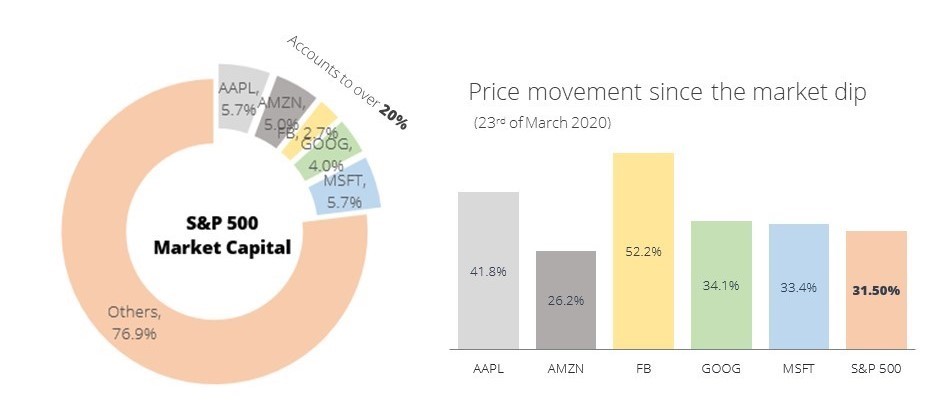

A disproportionate representation of large tech firms: In reference to the S&P 500, 20% of its market cap is represented by 5 tech giants (Facebook, Microsoft, Apple, Google, and Amazon) which have seen their stock prices surge amidst the current turmoil. It’s not a secret that these 5 companies were able to reap the best out of the bad times.

20% of the S&P 500 Market capital is owned by the 5 key tech giants

But this doesn’t necessarily mean that all businesses incl. SMEs and privately-owned businesses are seeing better prospects. According to the World Bank, SMEs represent 90% of businesses and 50% of employment worldwide. Formal SMEs represent 40% of national income in emerging economies. These numbers will be significantly higher when informal SMEs are included.

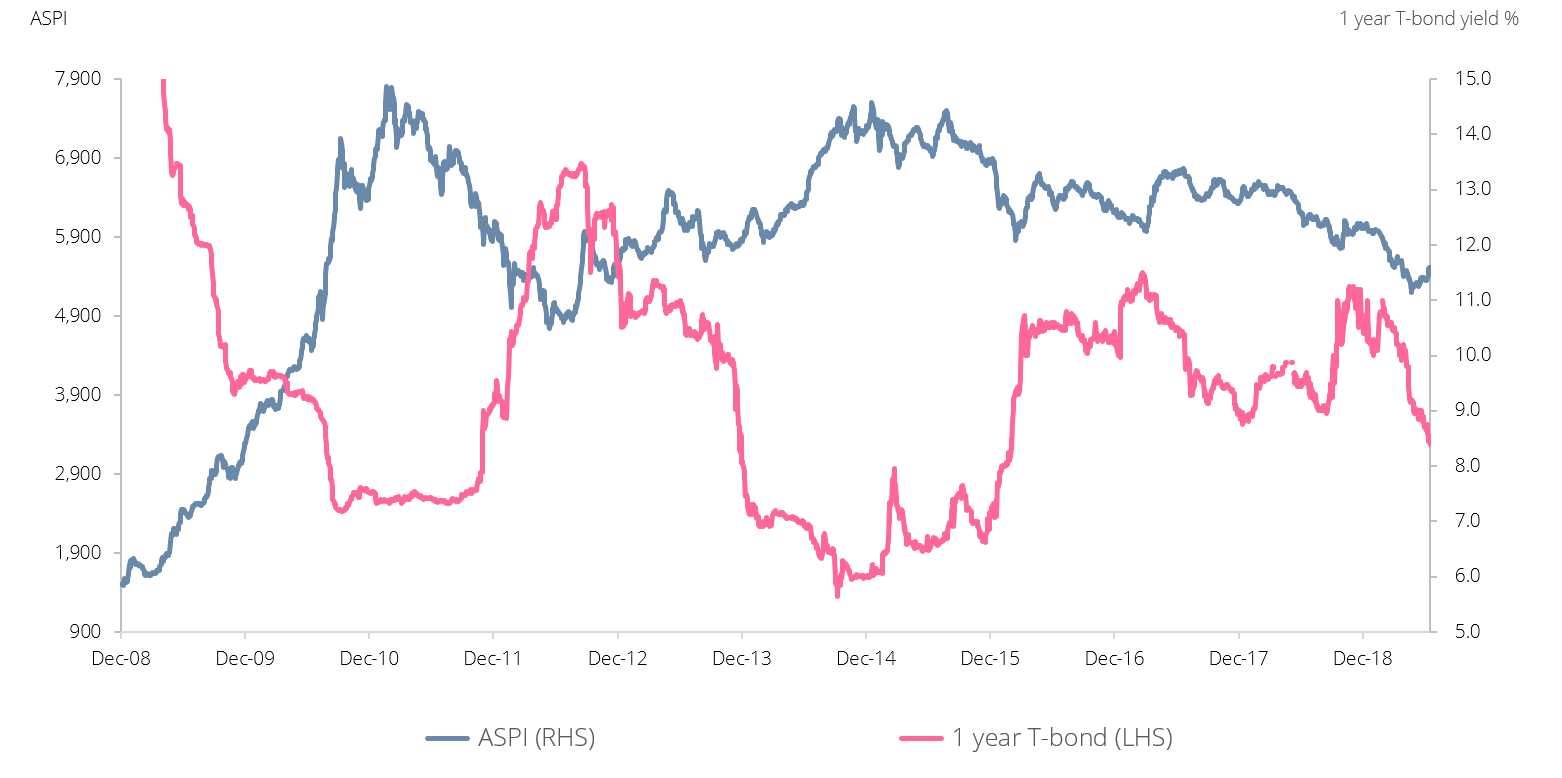

Lack of investment alternatives: If not for equities, what are the alternative investment options available for investors? If at all, the simplest alternatives would be bonds, debentures, or fixed deposits. Bonds: Bond yields have tumbled offering significantly lower returns over the fears of the new coronavirus. The yields on a 10-year US bond has plummeted to 0.6%, down from 3% in 2018. Fixed deposit: if you are a risk-averse investor and are willing to happily settle with lower returns, FD is your option. Debentures: less debentures will be issued by banks due to regulatory and covenant restriction.

Strong negative correlation between ASPI and bond yield (1 year)

Stock ownership profiles: Let the cat out of the bag, if you look at the stock ownership profiles of any market, the ownership will be heavily skewed to the richest segments of the population, who are less likely to feel the pain of an economic downturn. So, is the stock market performance a barometer of the overall economy in the current context?

- Quick Recovery?Addressing the elephant in the house. Out of the few reasons that forecast otherwise, I would like to bring global debt into focus.

It’s an open secret that the global debt burden is set to rise dramatically in 2020. To put this debt into context, global debt is now 40ppt (USD 87tn) higher than the onset financial crisis in 2008 and at a record high level of GDP (322% in 2019 and forecasted to be 342% in 2020E). Although this debt will provide a temporary stimulus for the economy, undoubtedly it has to be paid off at some point and it will be the public who has to bear it in a tax form (not to forget, global unemployment is peaking to the highest in the recent history). So, will the economy recover faster as investors expect? Based on previous history this scale of a hit to the economy we are currently experiencing could be felt for years but the very fact that this was the worst plummeted economic hit we might see the economy recovering fast.

Leaving my observations and findings for your thoughts and imaginations. I would like to end this note with a disclaimer, I never said current market valuations are right or wrong, maybe investors are too eager or maybe they are making the right move at the right time. Your guess is as good as mine. However, as markets proven time and time again, they can stay detached from the economy for a short period but in the long term, it has to reflect reality. After all, we can’t forget that in the past stock markets did predict economic crises.

Ishara Nilam – CAL Research