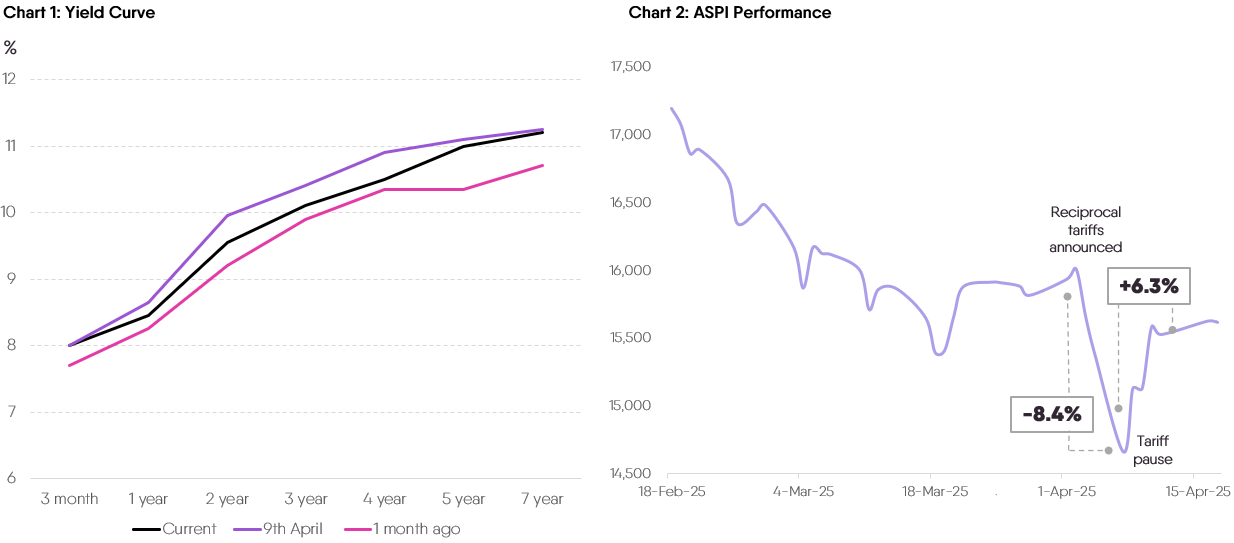

This month, all eyes were on President Trump’s tariff announcement, and just like everywhere else, it caused a stir in local markets, with Sri Lanka being slapped a 44% tariff, one of the highest in the world. The equity market took a nosedive, dropping 4.5% – its biggest one-day drop in 2 years, which was at the peak of the economic crisis. Government securities also lost ground, as yields rose between 20-50 bps across the curve (from the tariff announcement to the pause) which saw the Treasury utilize its cash buffers at auctions to limit volatility in interest rates while reducing borrowing needs from the market as recommended by the IMF.

Then, when the 90-day pause was announced, equity markets did a 180, bouncing back 4.7% in a single day, with bond yields falling 20-40 bps to date since the pause.

Low risk to external balances from US tariffs; positive for oil import bill

Sri Lanka’s apparel sector, a significant contributor to foreign income (the second largest source of foreign income, sending 37% of its goods to the US), understandably felt a tremor with President Trump’s tariff announcement. The worry was that buyers might shift orders to countries facing lower tariffs, compounding concerns about a contraction in global demand. However, our initial analysis indicates that a rapid exodus of orders is unlikely due to the time-intensive nature of supply chain adjustments.

Additionally, given the headway made by authorities on negotiations around a bilateral agreement, with strong willingness to accommodate reductions in tariffs on US imports, CAL believes that tariffs are unlikely to be imposed at 44% as initially expected. In fact, given the US’ aggressive stance on China, which exports USD 17.3 bn in apparel to the US (24% of US apparel imports), the dependency on alternate sourcing destinations like Sri Lanka could increase – causing Sri Lanka to potentially benefit from changing global trade patterns.

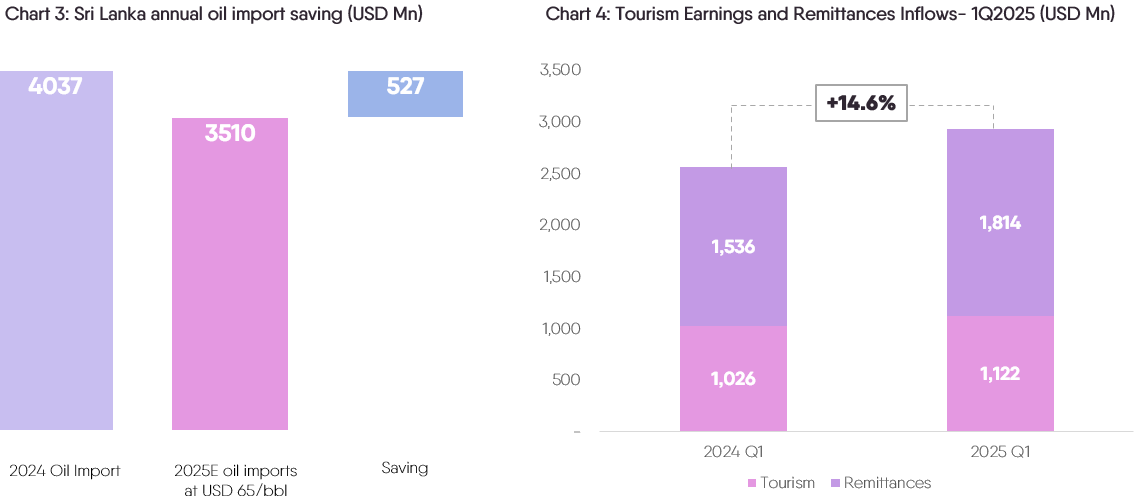

From a broader balance of payments perspective, the immediate picture offers a silver lining. The global upheaval caused by the tariffs could potentially lower Sri Lanka’s oil import costs by up to USD 530 mn, assuming current global price levels prevail. Additionally, robust remittances and strong tourism numbers in the first quarter have provided a welcome boost to the external sector.

Local festivities boost consumption, credit appetite grows

On the home front, Sri Lanka celebrated the Sinhala and Tamil New Year, a time that typically sees factories temporarily quiet down for the holidays resulting in a slowdown in production and manufacturing activity. However, it also sparks a surge in consumer spending. This year, our on-the-ground checks revealed particularly strong sales in the consumer durables space with items like TVs, ACs, and refrigerators being in high demand. This was partly due to lower prices thanks to a stronger rupee, but also because people had a bit more disposable income due to lower fuel and electricity costs, and wage increases in both the private and public sectors.

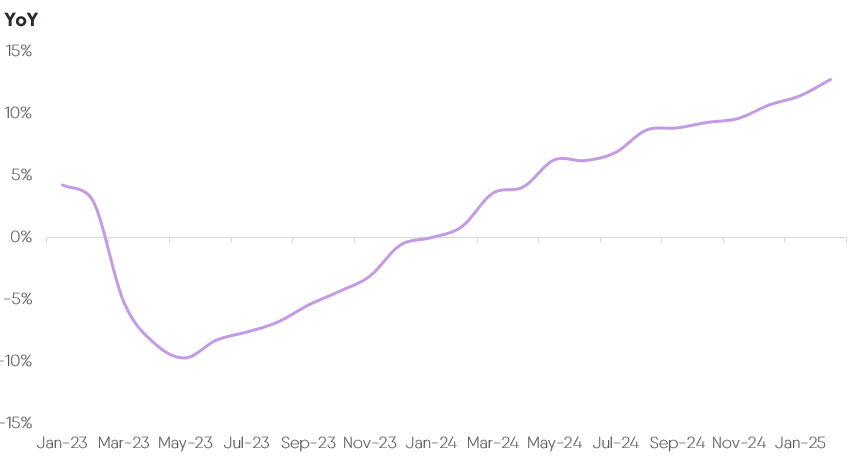

Cheaper credit is gradually becoming a key driver of economic activity, as banks and finance companies are eager to grow their loan portfolios now that investing in G-secs is less profitable. The financial sector expects credit to grow by at least 15%, but right now, finance companies seem especially eager to lend, while banks appear to be treading a bit more cautiously, focusing on lower-risk borrowers given the current levels of highest-risk Stage 3 loans at 12.3% (vs 12.8% in 2023)

Chart 5: Private Sector Credit Growth (YoY)

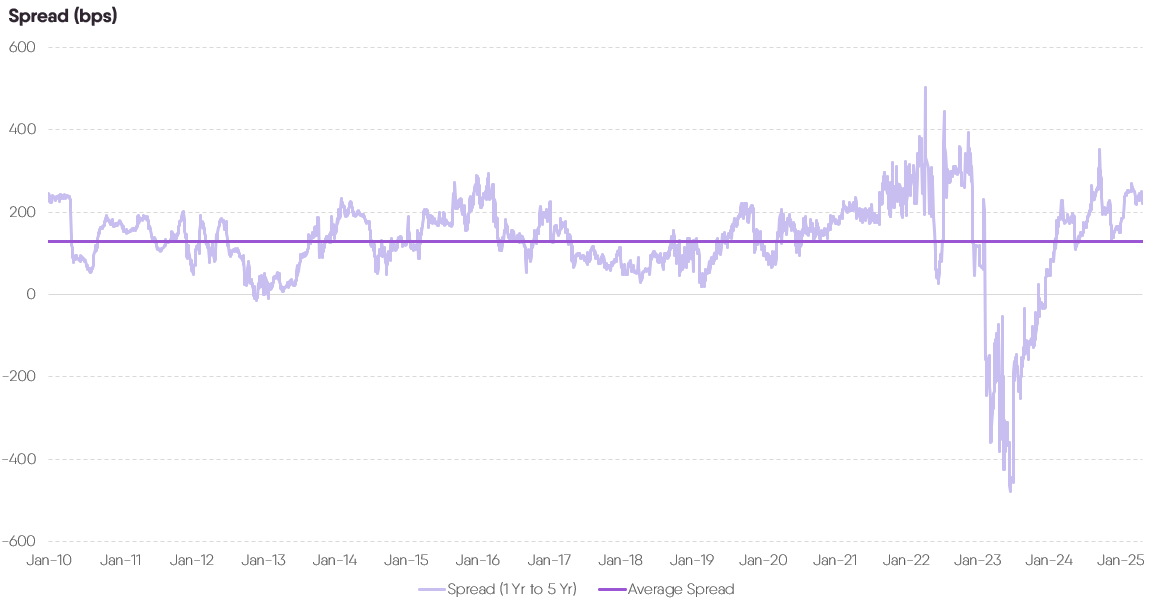

2025 outlook unchanged: Stable currency and room for lower rates

Looking ahead, we believe that lower global commodity prices will lead to lower inflation, which could prompt a downward revision of the Central Bank’s inflation projection. For 2026E, CAL estimates inflation to average at 4% vs CBSL’s projection of 5.6% – providing room for the central bank to cut policy rates by 25-50 bps within the next 3-6 months. This could mirror actions by global central banks such as the RBI and ECB who have maintained their monetary easing stance through rate cuts in April. As for G-secs, as the risk premium from tariff-related impacts eases off with more clarity, we anticipate yields would start to ease again, particularly on mid-to-longer term bonds, given their current spread to the 1-year lies above average.

Chart 6: Spread – 1 year vs 5 year

With more of a positive impact on the BOP in the near term, and the US dollar taking a beating, we don’t see currency pressure building up additionally from the tariffs themselves, with a range of LKR 305 – 310 (against the USD) by year-end being our base case. We are yet to see any major pressure coming in from the opening of motor vehicle imports after a 5 year hiatus, while the first ISB principal payment made in April has not imposed currency pressure as well.

Moreover, we see opportunities in the equity space, as we believe that economic and business conditions are likely to be more favourable than the market currently accounts for on a 44% tariff proposal.

Overall, even though Trump’s tariffs caused some worry, Sri Lanka’s economy has a few things going its way right now. Strong tourism and money coming in from overseas are helping. People at home are spending more with wallet pressure easing and seasonal festivities adding to it, while banks are starting to lend more. Questions still remain on how the US tariffs and the resulting changes to global trade will impact the country, with exporters especially being on guard. For the moment, it’s a waiting game to see how it plays out.